The Dow Jones Industrial Average (DJI30) saw a slightly upward trend during the US trading session yesterday.

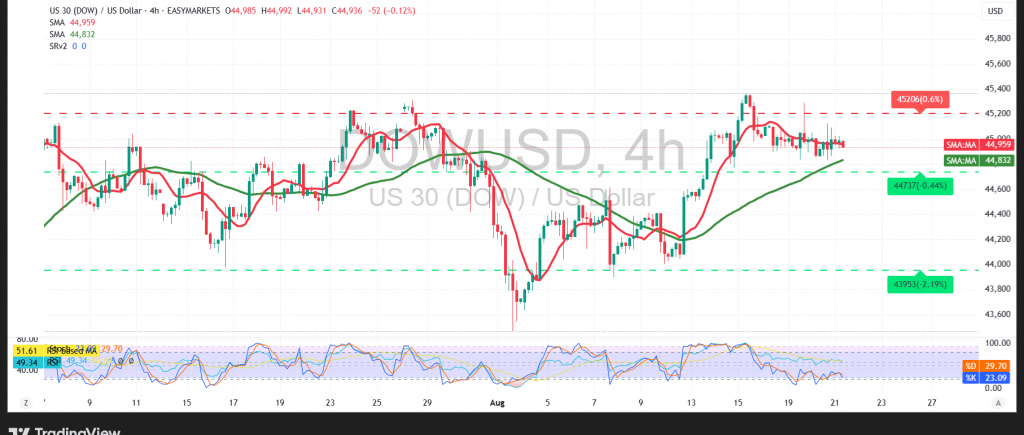

Technical Outlook – 4-Hour Timeframe

Technically, the index remains stable above the 50-day Simple Moving Average, which increases the chances of continued upward movement. This is supported by early positive signals from the Relative Strength Index, which is attempting to gain positive momentum that could push the index’s price higher.

Probable Scenario

As long as the price is stable in the short term above 44860, we may see an upward bias during today’s trading session, targeting 45095. A break of this resistance would be a catalyst that could strengthen the chances of a rise toward 45120, followed by 45240.

Conversely, a one-hour candle closing below the 44810 support level could place the index’s price under negative pressure, with the initial goal of retesting 44670.

Fundamental Note:

Today, we are awaiting high-impact economic data from the US economy: “Weekly Unemployment Claims, Preliminary Reading of the Services and Manufacturing PMI.” This data may cause strong price volatility when released.

Warning

The risk level is high amid current trade and geopolitical tensions, and all scenarios could be possible.

Disclaimer

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 44810 | R1: 45095 |

| S2: 44670 | R2: 45260 |

| S3: 44520 | R3: 45390 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations