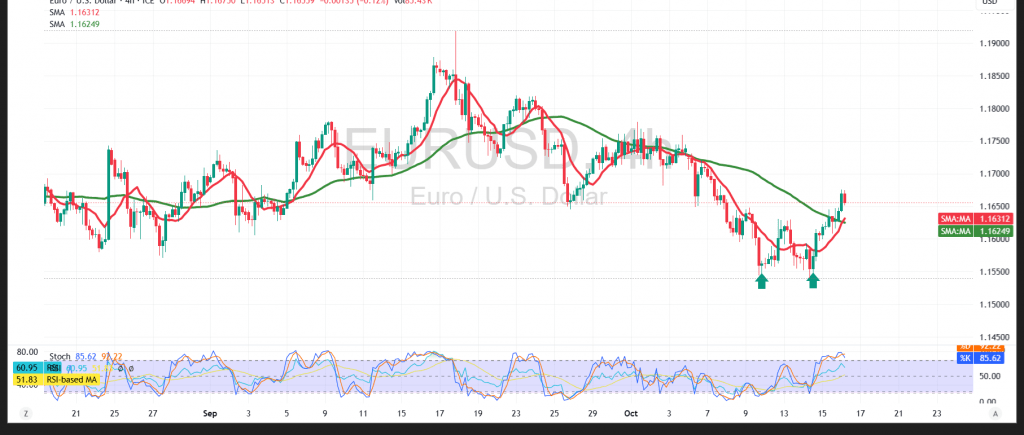

The pair staged a clear rebound after breaking above 1.1630, prompting a short-term reversal of the bearish tone that dominated recent sessions.

Technical Overview

- Trend context: While the broader structure remains bearish, price action is showing a bullish sub-trend intraday.

- SMAs: The simple moving averages have flipped to dynamic support, helping underpin the move from below.

- Momentum: The RSI has exited oversold territory, signaling improving upside momentum.

- Pattern: A developing double-bottom pattern reinforces near-term recovery prospects.

Probable Scenario

- Bullish case: Holding above 1.1610 favors an ongoing corrective rise toward 1.1690; a break higher would expose 1.1720 next.

- Bearish risk: A break below 1.1600 would likely reinstate selling pressure and reopen 1.1570, then 1.1540.

Caution

Risk remains elevated amid trade/geopolitical tensions; volatility spikes are possible, and multiple scenarios can play out.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1610 | R1: 1.1690 |

| S2: 1.1570 | R2: 1.1720 |

| S3: 1.1535 | R3: 1.1760 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations