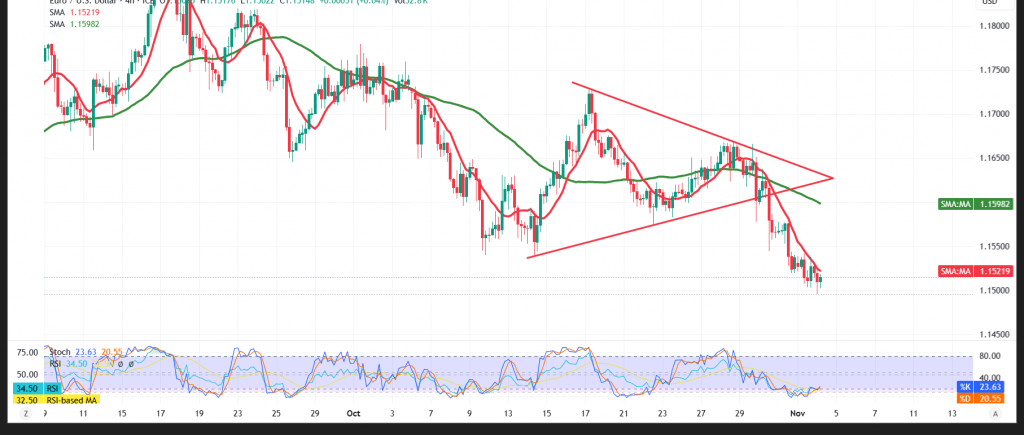

The pair hit our first target at 1.1500, printing a 1.1481 low.

Technical outlook

- Trend/SMAs: Price remains capped beneath the simple moving averages and continues to respect a descending trendline, preserving the bearish bias.

- Momentum (RSI): RSI has exited oversold without a convincing rebound—consistent with persistent selling pressure.

Base case (bearish while below 1.1560)

- As long as price holds below 1.1560 (former support now resistance), downside risk dominates.

- A decisive break/4H close below 1.1480 would open 1.1450, then 1.1420.

Invalidation / upside toggle

- Reclaiming 1.1560 (and building acceptance above it) would neutralize immediate downside pressure and allow a limited corrective push toward 1.1600.

Risk note

Volatility remains elevated amid trade tensions. Use prudent sizing and firm stops; reassess quickly if the levels above are breached.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1480 | R1: 1.1555 |

| S2: 1.1450 | R2: 1.1595 |

| S3: 1.1420 | R3: 1.1620 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations