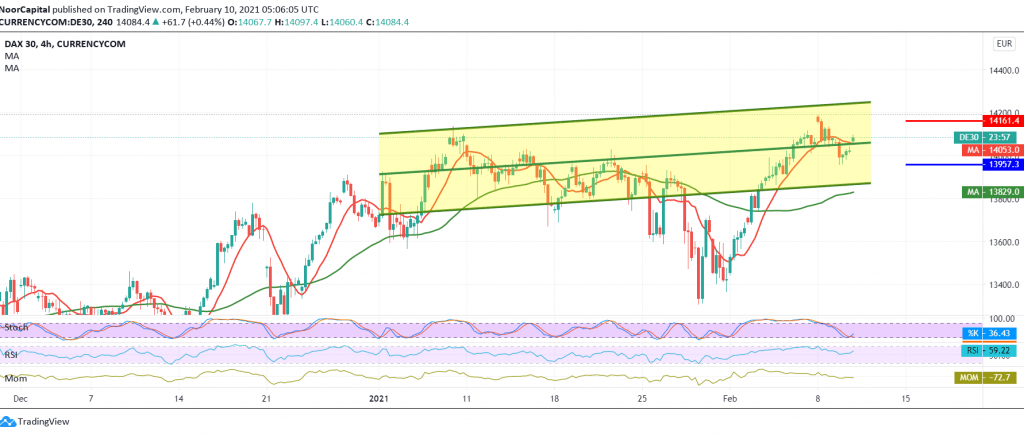

The German DAX index declined, eliminating the positive technical outlook as we expected, in which we relied on trading above 14,000, we indicated during the previous analysis that the attempt to break 14,000 postpones the chances of an upside and leads the index to re-test 13,950 to record a low of 13,955, continuing the upward rebound again, compensating Long position losses.

On the technical side today, with the index succeeding in maintaining trading above 13,950 and with the continuation of the positive motive of the 50 day moving average. This increases the probability of continuing the rally, targeting 14,065, and a breach of it leads the index to recover again, to be 14,110 the next stop.

From below, a break of 13,950 negates the bullish bias completely and puts the price under negative pressure, targeting 13,890 and may extend later towards 13,850.

Note: the level of risk may be high today.

| S1: 13950 | R1: 14065 |

| S2: 13895 | R2: 14110 |

| S3: 13845 | R3: 14175 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations