The US jobs data released on Friday revealed an improvement in the performance of the US economy in general during February, as labor market forces began to weaken with a decline in wage growth, which supports bets on interest rate cut by the Federal Reserve by June or even May 2024.

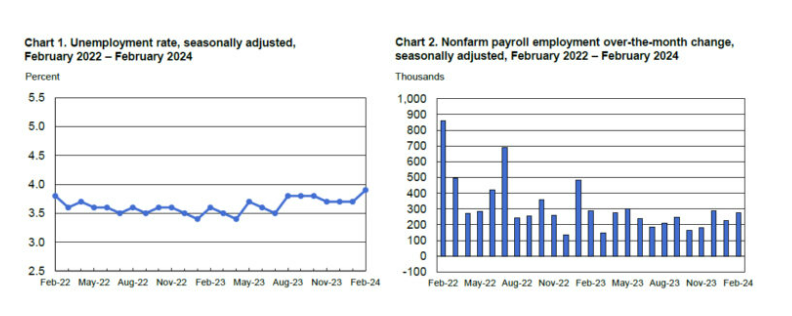

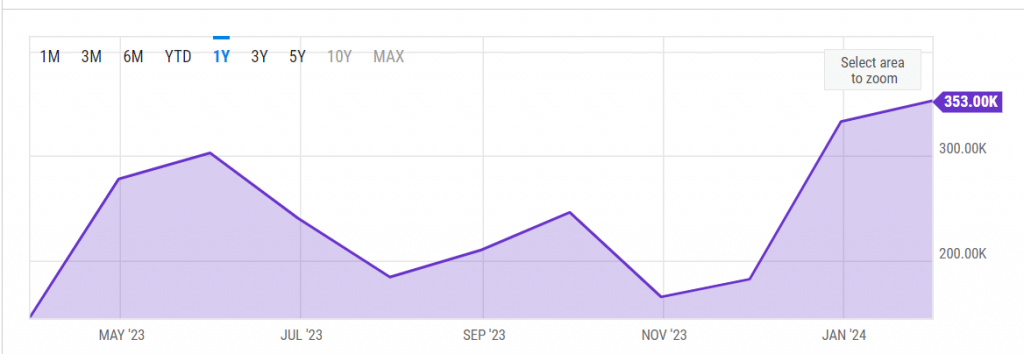

The Bureau of Labour Statistics said in its monthly report that the economy added 275,000 jobs in February after creating 229,000 jobs the previous month. This means that the economy added more than 1.5 million jobs in the past six months.

The unemployment rate in the United States rose by 0.2% in February, recording 3.9%, reaching its highest level since January 2022, exceeding market expectations that were standing at 3.7%. It means that the economy was able to achieve maximum employment, in a period when unemployment rate is below 5%. Also, wages continued to rise in February, growing by 0.1% month-on-month and 4.3% year-on-year. The labour force participation rate stabilized at 62.5%.

The importance of the jobs data for February lies in the fact that it came one day after the remarks by Fed Chair Jerome Powell, as part of his semi-annual testimony before the US Congress, which included a noticeable shift in the central bank’s rhetoric that included a tendency that Fed is no longer far from easing the monetary policy, and that interest cuts could begin this year.

Powell also indicated that the US central bank is confident that the inflation rate will eventually decline to stabilize at the Fed’s target at 2%, but he stressed the need for more data to ensure victory in Fed’s war against hot inflation.

The NFP print is specifically more important this month compared to previous months as it belongs to one of the two major categories of data on which the federal interest rate decision depends, as it is related to Fed’s twofold mandate to achieve maximum employment combined with maintaining price stability.

Strong jobs data means that inflation may remain at a high level for a while. Inflation tends to rise in light of the strength of the labour market because it increases the rate of consumer spending. But, after the recent NFP data had revealed that although US Non-farm Payrolls exceeded expectations in February, the figure had seen downward revisions during January and December.

While the unemployment rate surprisingly rose to its highest levels in two years, the rate of wage growth slowed less than expected, meaning that the data reflects a decline in the strength of the labour market. Now, following the release of the jobs report, the focus will be shift to the US Consumer Price Index (CPI) data, with economists believing that it will rise by 2.8% in February, while the core CPI is expected to rise to 3.7%.

The US job opportunities index recorded a decline to 8.863 million jobs last month, compared to the previous month’s reading of 9.026 million jobs, according to the JOLTS job opportunities Index issued by the US Department of Labour.

The US Consumer Confidence Index reading issued by the University of Michigan dropped to 76.9 points last February, compared to the previous reading, which recorded 79.6 points.

The US Challenger Job Loss Index rose to 84,600 jobs in the United States last month versus the previous reading of 82,300 jobs the previous month, indicating the highest levels in 11 months.

The employment component of the services PMI issued by the US ISM Institute recorded a decline to 48.00 points last February, which recorded 50.5 points.

The employment component of the manufacturing PMI issued by the US ISM Institute fell to 45.9 points last February, compared to the previous month’s reading of 47.1 points.

Market reaction to NFP data

The yield on 10-year US Treasury bonds fell to 4.07% after recent jobs data reinforced expectations that a rate cut is imminent, while the 20-year US bond yield rose to 4.35%, and the 30-year Treasury bond yield likewise rose to 4.26%.

The US dollar index – which measures the performance of the US currency against a basket of six competing currencies – also fell to 102.53 points, compared to 102.73 points, and the lowest level it reached during the current trading day was 102.35 points.

On the other hand, gold rose in spot trading to $2,169 per ounce, compared to $2,159 per ounce. Gold futures also rose, recording $2,178 per ounce, compared to $2,166 per ounce.

In the stock market, the S&P rose 0.56% to 5,186. The Nasdaq index also rose 0.83% to 16,399. The Dow Jones Industrial Average rose to 38,951 points.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations