Gold prices showed limited movement during the previous trading session but opened the early hours with a cautious rise after approaching oversold levels, recording a high of $3,343.

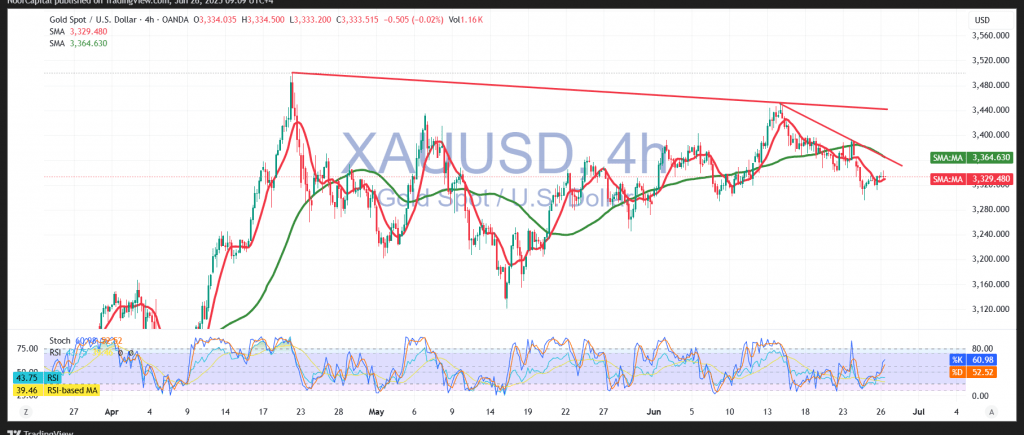

From a technical standpoint, gold appears to be attempting to recover some of its earlier losses. Intraday charts suggest a modest upward move, largely attributed to oversold conditions. However, the broader short-term trend remains bearish, evidenced by sustained activity along a descending trend line and price action holding below the simple moving averages, which continue to act as dynamic resistance levels.

Given these factors, the downside scenario remains valid. The immediate targets for the bearish move are 3,315 and then 3,298. If the 3,295 support level is broken decisively, it could accelerate selling pressure and drive prices toward 3,284.

The bearish outlook will remain in play as long as prices stay below the 3,346 resistance level. A confirmed break above this level would invalidate the downside scenario and could set the stage for a short-term recovery, with potential targets at 3,360 and 3,377.

Warning: Today’s US economic calendar includes the final Q1 GDP reading and weekly jobless claims, both of which could induce significant market volatility.

Warning: The risk environment remains elevated due to ongoing trade and geopolitical tensions, and all scenarios remain on the table.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations