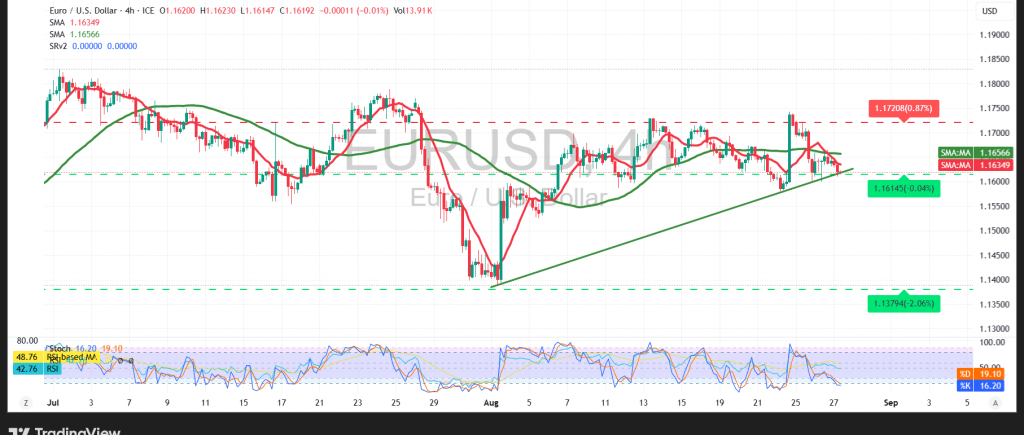

Mixed trading characterized the movements of the EUR/USD pair in the previous session, as it attempted to maintain stability above the 1.1600 level.

Technical Outlook – 4-hour timeframe:

Intraday action reflects the continuation of bearish pressure, with the pair remaining below the 50-period simple moving average, which acts as dynamic resistance around 1.1665. However, the Relative Strength Index (RSI) is attempting to generate positive momentum signals that could help ease selling pressure. In addition, price movements are still supported by an ascending trend line, which adds weight to the bullish case.

Probable Technical Scenario:

As long as the pair holds above the 1.1600 support, the bullish bias remains favorable, with an initial target at 1.1665. A break above this level would strengthen upside momentum, opening the way toward 1.1700 as the next objective.

Conversely:

A confirmed break below 1.1600 would expose the pair to renewed selling pressure, with downside targets projected at 1.1530.

Warning: Risks remain high amid ongoing trade tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1580 | R1: 1.1700 |

| S2: 1.1530 | R2: 1.1775 |

| S3: 1.1455 | R3: 1.1830 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations