The technical outlook remains intact, with USD/CAD continuing to trade within an upward corrective structure.

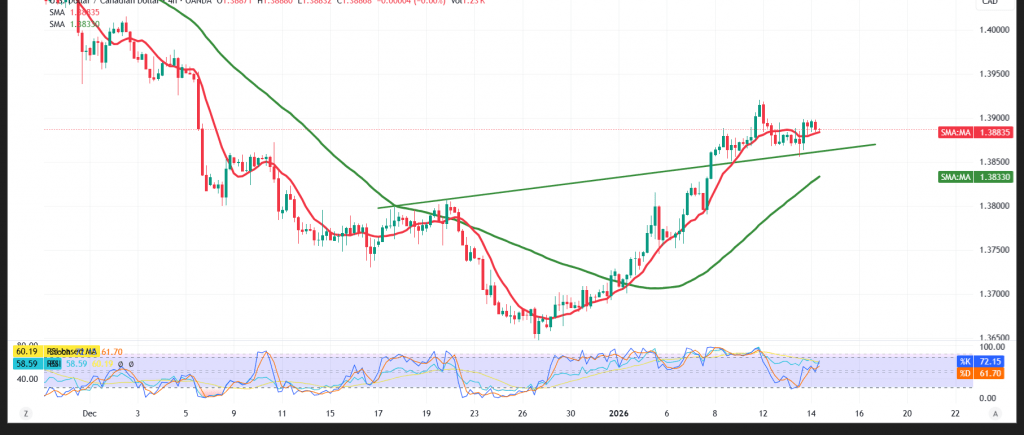

Technical Outlook – 4-Hour Chart

The corrective uptrend still dominates price action, supported by the pair holding above the simple moving averages, which sustain the bullish bias. At the same time, the Relative Strength Index (RSI) is displaying positive divergence after emerging from oversold territory, signaling a gradual recovery in momentum and reinforcing the case for further upside.

Expected Scenario

As long as price remains above the immediate 1.3850 support — and more importantly above the broader 1.3800 zone — the upward trajectory remains valid. A break above 1.3900 would likely accelerate gains toward 1.3940, with scope for extension toward 1.3970.

On the downside, a renewed break below 1.3800 would weaken the bullish structure and could trigger a corrective pullback, with an initial downside target around 1.3750.

Market Warnings:

- High-impact U.S. economic data is due today, particularly the monthly Producer Price Index (PPI) and Retail Sales figures, which may trigger sharp volatility.

- Risk levels remain elevated amid ongoing trade and geopolitical tensions, keeping all scenarios on the table.

Risk note

Headline risk is elevated. Use prudent sizing and firm stops; reassess quickly if these trigger levels give way.

| S1: 1.3850 | R1: 1.3905 |

| S2: 1.3800 | R2: 1.3940 |

| S3: 1.3755 | R3: 1.3970 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations