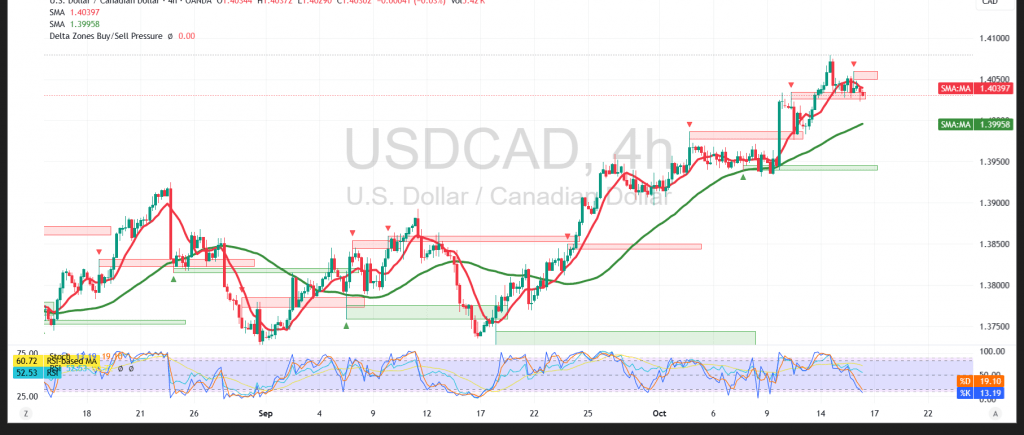

USD/CAD is correcting lower in a bearish sub-trend within the broader uptrend, as markets consolidate recent gains ahead of policy headlines.

Technical:

RSI is attempting to exit oversold, hinting at base-building for a rebound. Price continues to hold above the 50-period SMA, keeping the larger bullish structure intact. The 1.4000 zone (former resistance turned support) remains pivotal.

Base case:

While above 1.4000, upside risk persists. A confirmed break through 1.4065 would likely open 1.4095, then 1.4120.

Alternative:

A decisive drop below 1.4000 would revive downside pressure toward a retest of 1.3960.

Risk:

The Bank of Canada Governor’s speech today may trigger sharp swings. Maintain disciplined sizing and clear invalidation levels; conditions may not suit all risk profiles.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.4000 | R1: 1.4065 |

| S2: 1.3960 | R2: 1.4095 |

| S3: 1.3930 | R3: 1.4130 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations