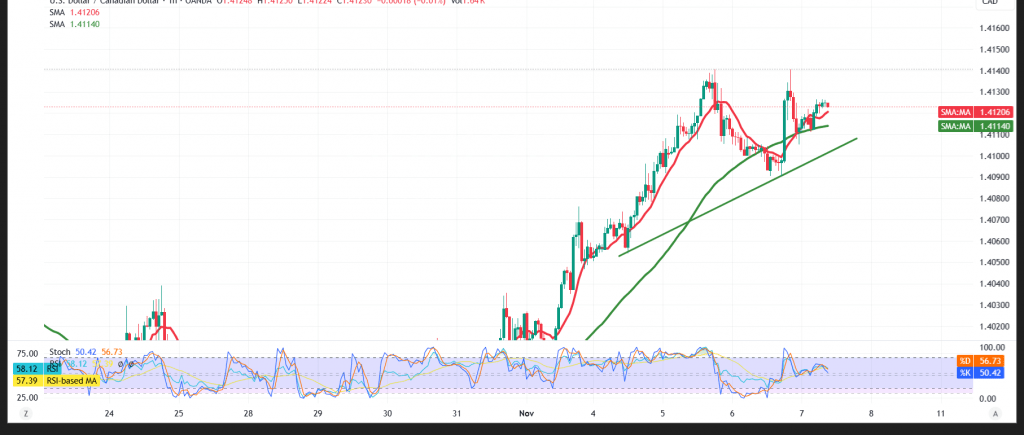

USD/CAD extended its advance in line with prior bullish calls, tagging the 1.4120 target and printing a 1.4140 high.

Technical outlook

- Structure: The break above the descending trendline is intact.

- SMAs: Simple moving averages have rotated beneath price, providing support.

- RSI: Easing from overbought without breaking down—consistent with scope for continued upside.

Base case (bullish while above 1.4095)

- Holding 1.4095 keeps momentum constructive toward 1.4145.

- A decisive break/4H close above 1.4145 would likely extend to 1.4175.

Alternative / pullback

- A 4H close below 1.4095 would soften the bias and favor a retest of 1.4065, then 1.4030.

Risk note

Volatility is elevated amid trade and geopolitical headlines. Use prudent sizing and firm stops; reassess quickly if these key levels give way.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.4095 | R1: 1.4145 |

| S2: 1.4065 | R2: 1.4175 |

| S3: 1.4030 | R3: 1.4200 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations