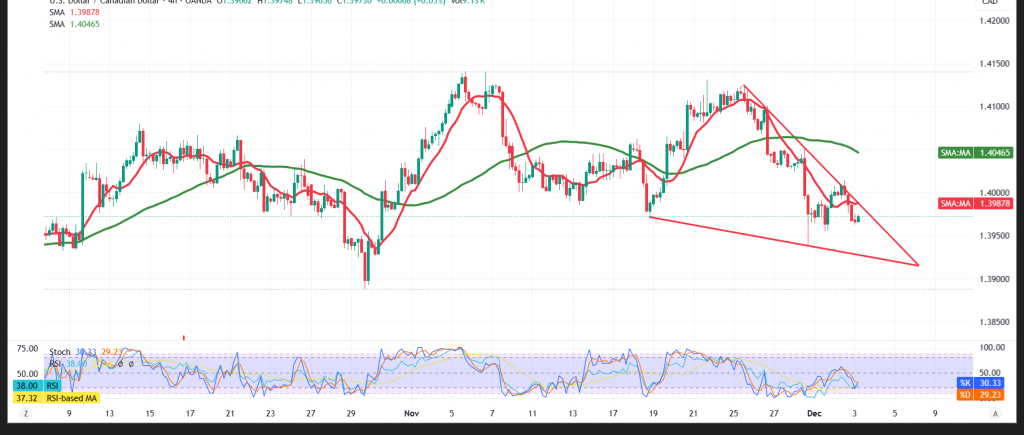

The USD/CAD pair saw a sharp decline after failing to sustain trading above the key psychological resistance at 1.4000, pushing the pair firmly into a bearish trend.

Technical Outlook – 4-Hour Timeframe:

Simple moving averages continue to apply downward pressure, reducing the likelihood of any meaningful recovery. The Relative Strength Index (RSI) also maintains its negative signals, indicating weak bullish momentum and reinforcing the bearish outlook.

Likely Scenario:

As long as the price remains below 1.4000, the bearish trend is favored. A confirmed break below 1.3950 would likely open the way toward the initial support at 1.3900.

On the other hand, regaining stability above the psychological level of 1.4000 could temporarily pause the current downtrend and allow for a corrective move toward 1.4040.

Warning: Highly significant U.S. economic data is due today, including the Non-Farm Private Sector Employment Change and the ISM Purchasing Managers’ Index (PMI). Elevated price volatility is expected around the release.

Warning: Trading risk remains high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk note

Headline risk is elevated. Use prudent sizing and firm stops; reassess quickly if these trigger levels give way.

| S1: 1.3950 | R1: 1.4000 |

| S2: 1.3900 | R2: 1.4040 |

| S3: 1.3870 | R3: 1.4070 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations