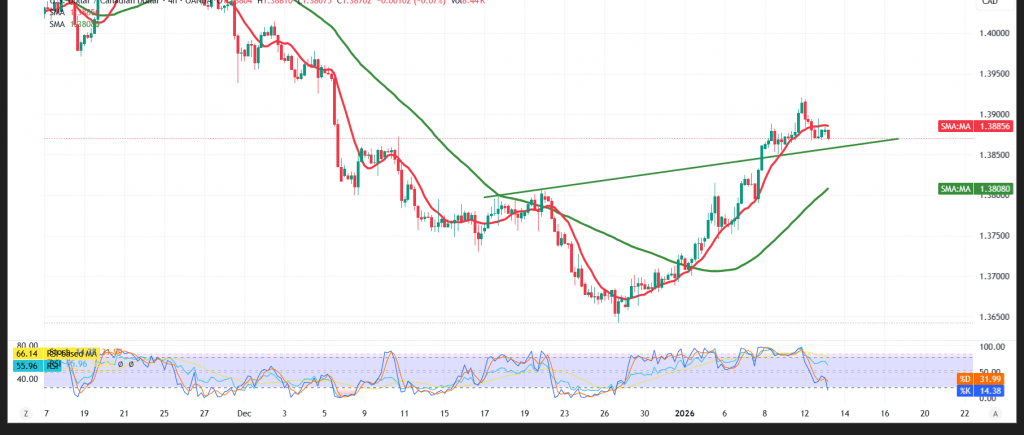

The USD/CAD pair came under early selling pressure today, with price action leaning lower as the market searched for a near-term support base.

Technical Outlook – 4-Hour Chart

Despite the initial weakness, the broader corrective uptrend remains in place. Price continues to trade above the simple moving averages, which maintain a bullish structural bias. In addition, the Relative Strength Index (RSI) is showing positive divergence after emerging from oversold territory, signaling a potential recovery in buying momentum.

Expected Scenario

As long as the pair holds above the immediate support at 1.3850 — and more importantly above the broader 1.3800 zone — the upside bias remains valid. A break above 1.3900 would likely accelerate gains, opening the door toward 1.3940.

On the other hand, a renewed break below 1.3800 would weaken the bullish structure and could trigger a corrective decline, with an initial downside target around 1.3750.

Market Warnings:

- High-impact U.S. economic data is due today, particularly the monthly and annual Consumer Price Index (CPI), which could trigger sharp volatility.

- Risk levels remain elevated amid ongoing trade and geopolitical tensions, keeping all scenarios on the table.

Risk note

Headline risk is elevated. Use prudent sizing and firm stops; reassess quickly if these trigger levels give way.

| S1: 1.3850 | R1: 1.3900 |

| S2: 1.3800 | R2: 1.3940 |

| S3: 1.3755 | R3: 1.3970 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations