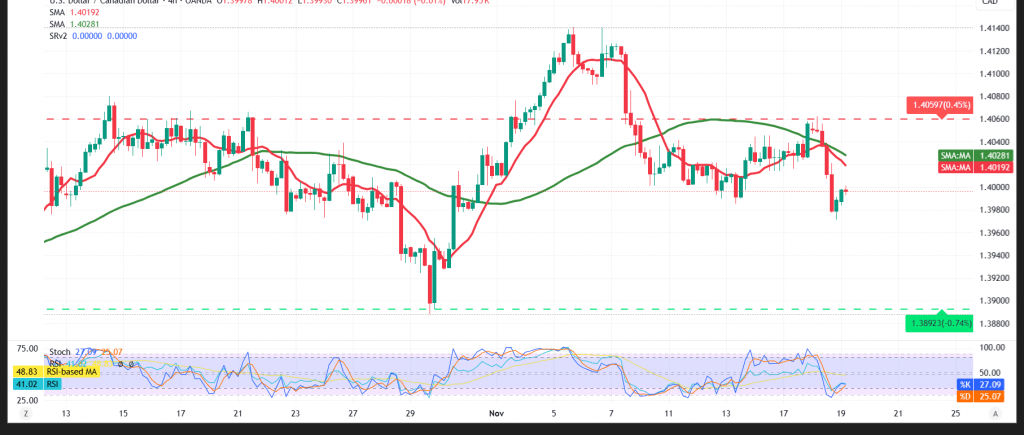

Selling pressure dominated the USD/CAD pair after it encountered resistance at 1.4060, forcing it into negative trading.

Technical Outlook – 4-Hour Timeframe

The simple moving averages have returned to exert downward pressure on the price and are acting as a dynamic resistance level. This is further supported by negative signals from the Relative Strength Index (RSI).

Likely Scenario:

If the price remains below 1.4020, the downward pressure will increase. A confirmed break below 1.3990 would facilitate a move towards 1.3960, an initial support level that could later extend to 1.3920.

Conversely, a return to stability above 1.4020 could halt the downward trend and lead the pair to attempt to resume its upward trajectory, with initial targets at 1.4050.

Note: Today, we await the release of the Federal Reserve meeting minutes, which may lead to high price volatility.

Warning: The level of risk is high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk note

Headline risk is elevated. Use prudent sizing and firm stops; reassess quickly if these trigger levels give way.

| S1: 1.3960 | R1: 1.4050 |

| S2: 1.3920 | R2: 1.4100 |

| S3: 1.3865 | R3: 1.4145 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations