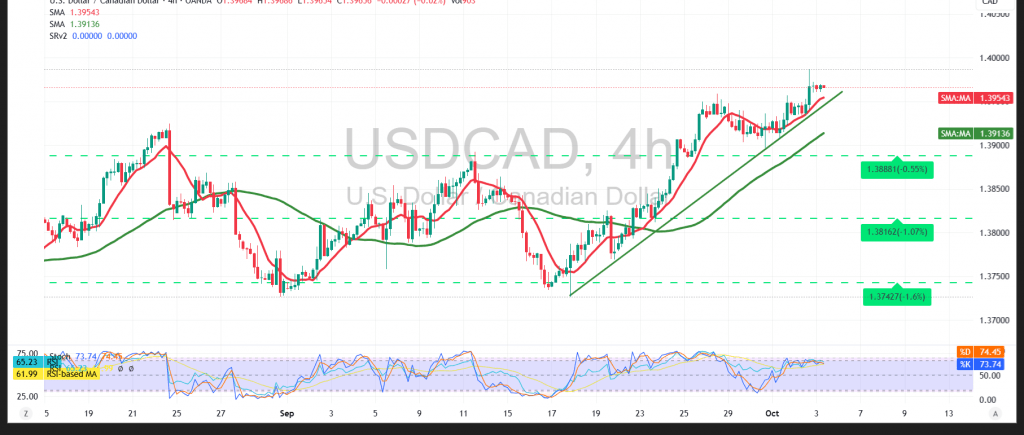

The pair maintained its bullish momentum, reaching the official target at 1.3970 and recording a session high of 1.3986.

Technical Outlook:

- RSI: Continues to issue positive short-term signals, reflecting sustained bullish momentum.

- 50-day SMA: Price action remains above the moving average, providing dynamic support to the uptrend.

Probable Scenario:

- Bullish Case (preferred): Holding above the previously broken resistance turned support at 1.3940 strengthens the bullish outlook. A move higher could target 1.3990, with potential gains extending towards 1.4020.

- Bearish Case (alternative): A confirmed break below 1.3940 could expose the pair to downside pressure, with the possibility of revisiting the 1.3900 support area.

Event Risk: High-impact US economic data is due today (Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings). Sharp volatility is expected during and after the releases.

General Warning: Risk remains elevated amid persistent trade and geopolitical tensions.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3940 | R1: 1.3990 |

| S2: 1.3905 | R2: 1.4020 |

| S3: 1.3880 | R3: 1.4050 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations