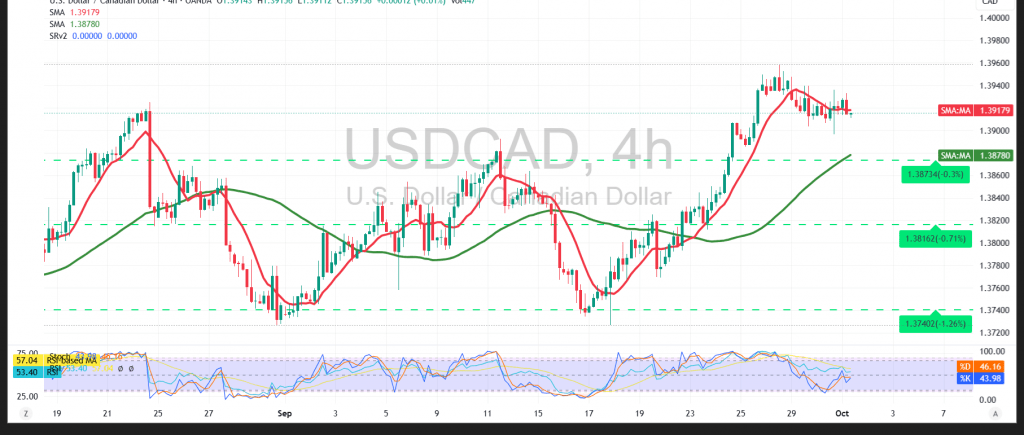

The pair remains in an upward trend, attempting to consolidate above the 1.3900 level while maintaining a positive technical structure.

Technical Outlook:

- RSI: Sending early positive signals, supporting short-term bullish momentum.

- 50-period SMA: Prices remain above it, reinforcing the upside bias.

Probable Scenario:

- Bullish Case: As long as trading holds above 1.3880, upside potential remains in place. A break above 1.3950 would confirm bullish momentum and pave the way toward 1.3970.

- Bearish Case: A downside break of 1.3880 could place the pair under renewed pressure, targeting 1.3850 and then 1.3810.

Risk Warning: High volatility is expected with today’s release of US ADP Nonfarm Employment Change and ISM Manufacturing PMI data. Geopolitical and trade-related risks remain elevated, and all scenarios are possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3895 | R1: 1.3940 |

| S2: 1.3850 | R2: 1.3970 |

| S3: 1.3810 | R3: 1.4000 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations