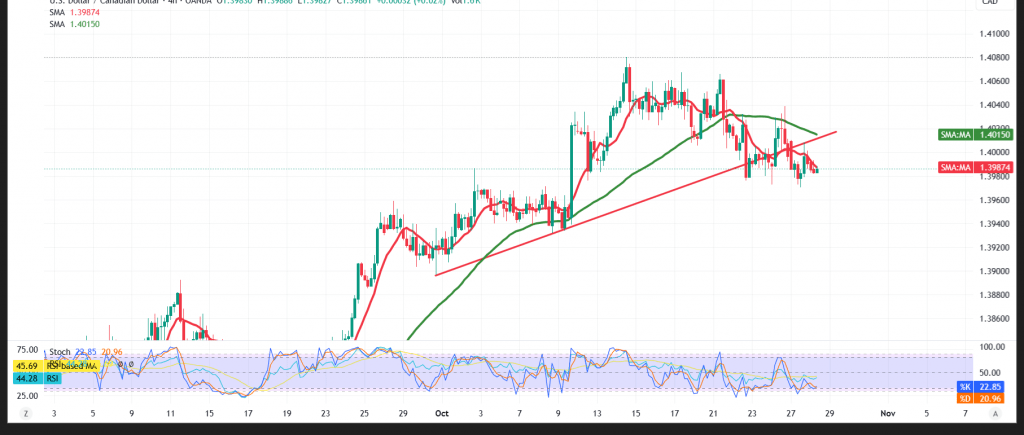

USD/CAD’s rally stalled at the 1.4000 psychological barrier, with volatility elevated as the level repeatedly repels upside attempts.

Technical outlook

- Price has broken the ascending support line, shifting near-term structure from higher lows to a corrective/downward bias.

- Simple moving averages have rolled over and now sit above price, acting as dynamic resistance and reinforcing downside pressure.

Base case (favored)

While 1.4010 holds as resistance, the path of least resistance is lower toward 1.3970, then 1.3940 (next support area).

Alternative case (topsides re-tested)

A decisive break above 1.4010 would neutralize immediate downside momentum and could accelerate a retest of 1.4045.

Key levels

- Support: 1.3970, 1.3940

- Resistance: 1.4010, 1.4045, 1.4000 (psych.)

Risk note

Headline risk remains elevated amid trade and geopolitical tensions; multiple scenarios are possible. This analysis is for information only and is not investment advice.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3970 | R1: 1.4045 |

| S2: 1.3940 | R2: 1.4090 |

| S3: 1.3905 | R3: 1.4115 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations