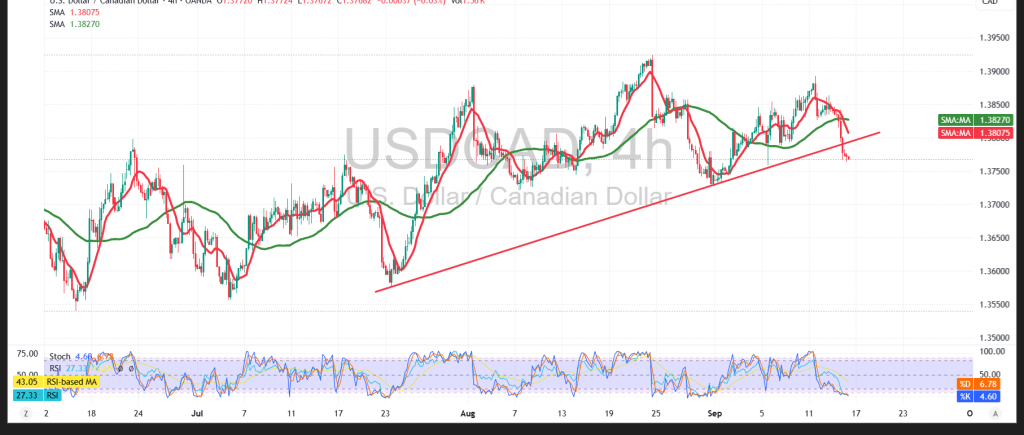

The USD/CAD pair came under strong selling pressure after failing to sustain stability above the psychological barrier of 1.3800.

Technical Outlook – 4-hour timeframe:

Intraday price action is tilting downward, with the simple moving averages now acting as dynamic resistance, pressing on the pair from above. In addition, the break of the ascending trend line, as shown on the chart, reinforces the bearish bias.

Probable Scenario:

The downside bias is expected to dominate today’s trading, with the pair likely to test support at 1.3740. A confirmed break of this level could extend losses toward 1.3700. Conversely, a confirmed breakout above the 1.3800 psychological resistance—and more importantly 1.3820—would invalidate the bearish view and could trigger a recovery toward 1.3875.

Fundamental Note:

Today’s session includes high-impact U.S. economic data (retail sales) and Canada’s Consumer Price Index (CPI) (monthly and annual). These releases may lead to sharp volatility in the pair.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3740 | R1: 1.3820 |

| S2: 1.3700 | R2: 1.3875 |

| S3: 1.3655 | R3: 1.3905 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations