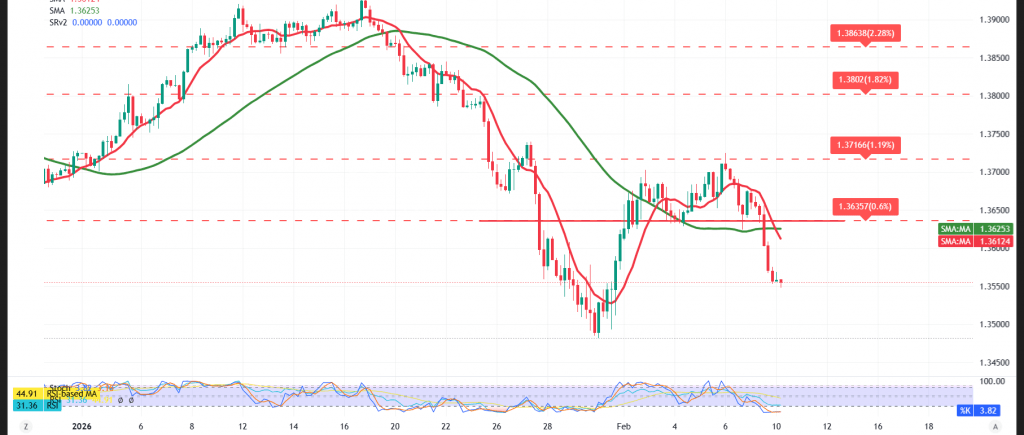

The USD/CAD pair remains under strong bearish pressure, extending its decline to a low near 1.3548 and confirming the dominance of the downtrend.

Technical Outlook – 4-Hour Chart

Simple moving averages continue to cap price action from above, acting as dynamic resistance and reinforcing the continuation of the downward move. This bearish structure is further strengthened by the clear break below the key 1.3600 support level, which has now turned into resistance in line with the role-reversal principle.

Expected Scenario

As long as trading remains below 1.3600 — and more broadly beneath the 1.3640 resistance zone — the bearish trend is expected to persist, with 1.3510 standing as the next initial downside target.

It is worth noting that the Relative Strength Index (RSI) is currently in oversold territory, which could lead to increased volatility or short-term corrective fluctuations before a clearer directional move resumes.

Market Note:

High-impact U.S. economic data is due today, including monthly Retail Sales and the Employment Cost Index. Elevated volatility is expected around the release.

Risk Warning:

Market conditions remain high-risk amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Risk note

Headline risk is elevated. Use prudent sizing and firm stops; reassess quickly if these trigger levels give way.

| S1: 1.3510 | R1: 1.3640 |

| S2: 1.3465 | R2: 1.3720 |

| S3: 1.3380 | R3: 1.3765 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations