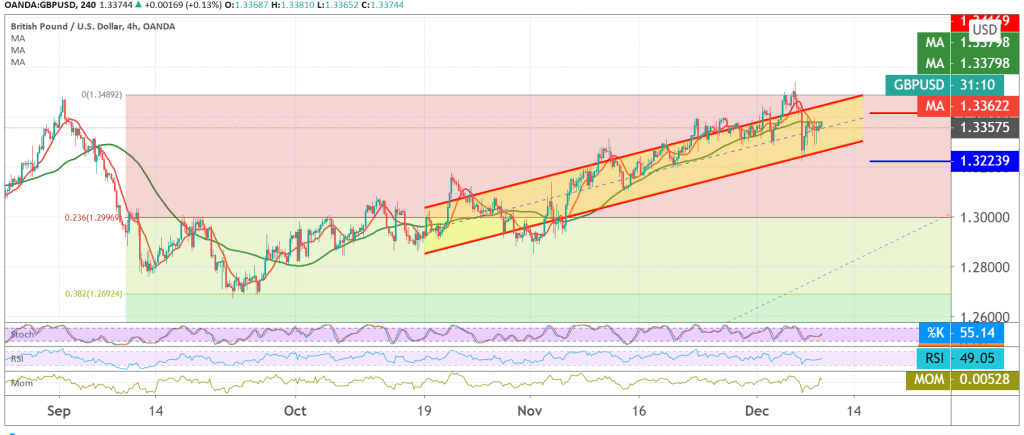

The British pound opened its early trades for the current session with a slight upward slope after several consecutive sessions of retreat against the US dollar within limited attempts to rise, benefiting from the psychological barrier support level of 1.3300.

On the technical side, the price has stabilized below the previously breached support-into-resistance 1.3410, accompanied by negative pressure coming from the 50-day moving average.

Therefore, the bearish tendency is likely today, targeting 1.3300 / 1.3280 as a first target, taking into account that trading below the last extends the losses of the pair so that the way is directly open towards 1.3240, and the price behaviour of the pair should be monitored around 1.3240 because breaking it pushes the pair into a strong downside wave targeting 1.3130.

on the upside, Consolidating again above 1.3410, and most importantly 1.3450, which will stop the expected bearish scenario, and we will witness a bullish tendency, targeting 1.3500 / 1.3520 again.

| S1: 1.3315 | R1: 1.3420 |

| S2: 1.3250 | R2: 1.3455 |

| S3: 1.3210 | R3: 1.3520 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations