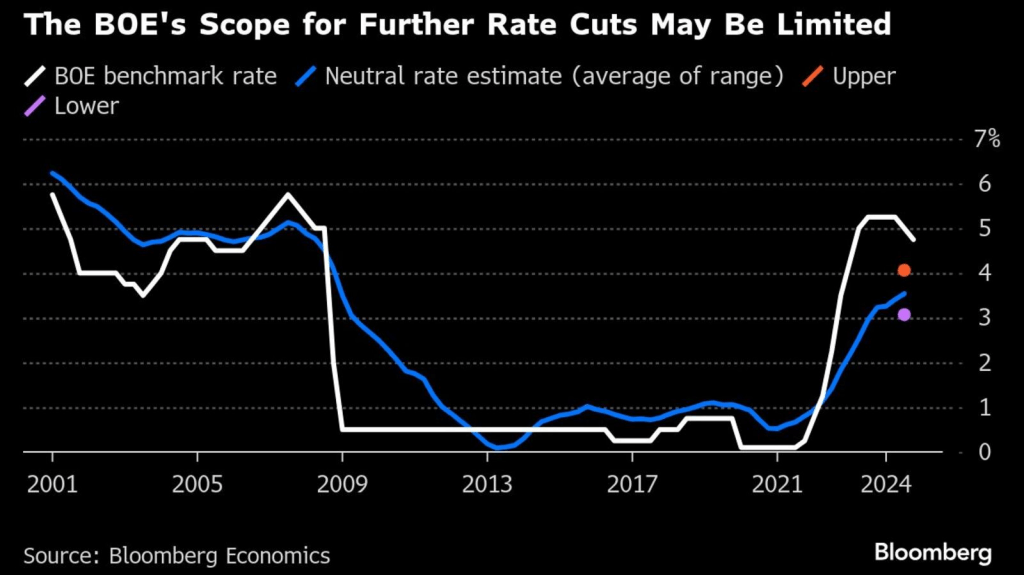

The Bank of England is set to announce its monetary policy decision early on Thursday. Governor Andrew Bailey has signaled that the central bank is likely to keep the main interest rate on hold, emphasizing a gradual approach to monetary easing. Despite this cautious stance, Bailey recently indicated that up to four rate cuts might be possible in 2025, contingent on inflation continuing its downward trajectory.

Source: Bloomberg

Market Expectations vs. Official Guidance

Investors and traders are increasingly betting on fewer interest-rate cuts by the BoE next year. This sentiment diverges from the official guidance provided by the Monetary Policy Committee (MPC). Money markets currently forecast just 49 basis points of monetary easing through the end of 2025, down from over 70 basis points predicted earlier in the week. This contrasts with the 100 basis points indicated by several officials within the MPC as a base case scenario.

This divergence in outlook has heightened anticipation ahead of Thursday’s decision. Most economists expect the BoE to hold its key rate steady at 4.75%, with significant attention on forward guidance. The expectation is that the MPC will likely adopt a slightly dovish tone, reflecting the market’s cautious stance on future rate cuts.

Data-Driven Market Adjustments

The shift towards fewer expected rate cuts began earlier in the week following UK employment data, which showed wages increasing more than forecast. This fueled concerns about persistent inflationary pressures. Although consumer price figures released on Wednesday met economists’ expectations, services inflation remained high at 5%, offering little relief to inflation concerns closely monitored by the BoE.

Impact on Gilts and the Pound

Despite cutting rates only twice this year, the BoE’s cautious approach has supported the pound, which has outperformed other Group-of-10 currencies against the dollar in 2024. However, this caution has weighed on gilts, exacerbating their underperformance and widening the yield gap between UK and German government bonds to levels last seen in 1990.

The yield on two-year gilts, which are highly sensitive to monetary policy changes, rose by 16 basis points this week to 4.46%, while the 10-year yield increased by 15 basis points to 4.56%. The pound also strengthened, trading just below $1.27. Market analysts suggest that the adjustments in gilt yields could continue into 2025, with potential significant impacts on returns.

Economic Outlook and Scenarios

The BoE is expected to leave its guidance from the November meeting largely intact, emphasizing a gradual approach to rate cuts. The central bank may tweak its fourth-quarter growth forecast due to a string of disappointing figures, potentially lowering it from the previously predicted 0.3%. Recent data revealed the first pickup in wage growth in over a year and inflation at an eight-month high, suggesting that inflationary pressures remain.

Traders will be looking for any hints about which of the BoE’s three inflation scenarios officials see as most likely. These scenarios range from a benign outcome where inflation dissipates quickly, to a case requiring prolonged restrictive policy due to structural changes in wage and price-setting behavior.

Policy and Tax Increases

The BoE may provide more insight into the impact of Chancellor of the Exchequer Rachel Reeves’ £26 billion hike in employer national insurance contributions, a key component of the Labour government’s recent budget. Policymakers are uncertain how businesses will react, whether by increasing prices, cutting jobs, or restraining pay rises.

This uncertainty adds complexity to the BoE’s policy decisions. The outlook for interest rates next year will heavily depend on how firms respond to these increased payroll costs. The BoE’s cautious stance underscores its commitment to managing inflation while supporting economic growth.

The BoE’s forthcoming decision is expected to reflect a balance between caution and the need to address inflationary pressures. Forward guidance will play a crucial role in shaping market expectations for 2025, as the central bank navigates the complex economic landscape ahead. The emphasis on patience and gradualism suggests that while rate cuts are on the horizon, they will be implemented cautiously to ensure economic stability.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations