Since its January meeting, the Bank of Canada has refrained from using the phrase “the bank is still ready to raise interest rates if necessary,” which was previously a frequent mention in its statements. This adjustment comes at a time when the market anticipates rate cuts by other central banks. With the Canadian interest rate decision scheduled for this week, there is speculation about whether the bank will merely remove this phrase or if it will follow the lead of its counterparts by hinting at a potential interest rate cut.

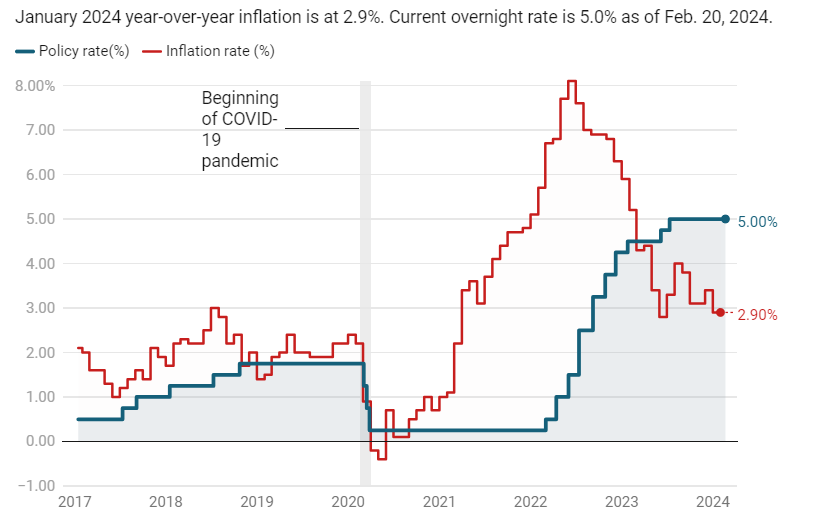

Economists generally expect the Bank of Canada to maintain patience at its upcoming meeting and keep the interest rate unchanged at 5%, with the first potential rate cut expected in June. This approach aligns with favorable economic conditions that suggest the possibility of interest rate reductions in the near future.

By taking this stance, the Bank of Canada aims to closely monitor GDP figures and their impact on the trajectory of interest rates. Economic analysts suggest that the Canadian economy’s growth has begun to slow down, which corresponds with the levels anticipated by the central bank.

Recent Canadian economic data indicates that the annual inflation rate reached 2.9% in January, with forecasts suggesting that price pressures are expected to ease toward the bank’s 2% target by 2025. This represents a decline from December’s 3.4% increase. Additionally, fourth-quarter GDP figures exceeded the Bank of Canada’s expectations, with analysts projecting a growth rate of 0.8%. However, monthly GDP growth fell short of the target, remaining unchanged in December, primarily driven by higher exports and lower imports.

Economists argue that the Bank of Canada needs to reconsider its approach to inflation, given the significant influence of the housing sector on inflationary pressures. They point out that more than half of Canada’s total inflation stems from housing costs, making it the primary obstacle preventing the central bank from achieving its inflation target of 2%.

Adjusting government spending is seen as crucial in reducing interest rates. Economic analysts suggest that Canadian Prime Minister Justin Trudeau must revise spending levels in his upcoming budget to facilitate a quicker reduction in interest rates and alleviate the cost-of-living pressures that are negatively impacting his approval ratings.

Trudeau has notably increased support for public health and social services programs over the past eight years, with spending further elevated during the COVID-19 pandemic, resulting in Canada’s largest budget deficit since World War II.

Bank of Canada Governor Tiff Macklem has consistently cautioned that the high level of government spending, both at the federal and provincial levels, is not conducive to curbing elevated inflation rates. Furthermore, Macklem warns that such spending could impede the central bank’s ability to implement interest rate cuts effectively.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations