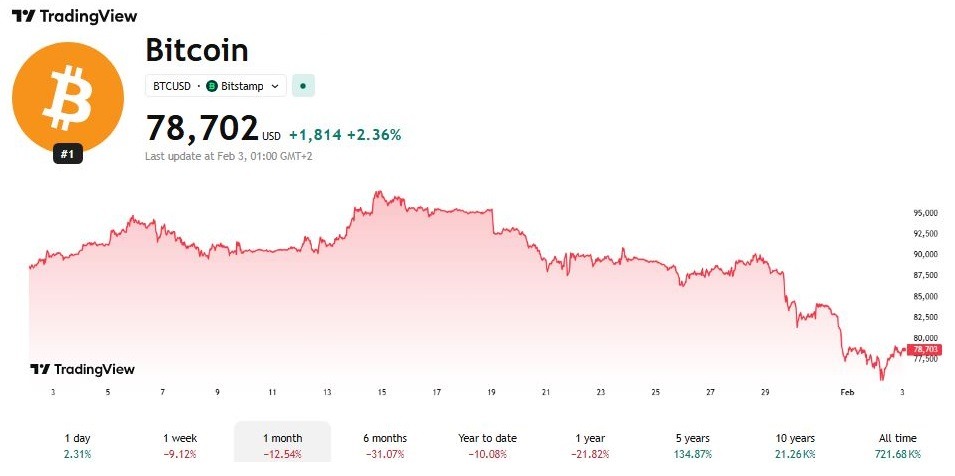

As of February 3, 2026, Bitcoin (BTC) is trading around $78,000–$79,000 USD, reflecting a sharp pullback from its all-time high (ATH) of approximately $126,080 reached in late 2025.

Despite the optimistic +2.38% increase, from the previous closing rate, chats point to a decline of over 35–38% from the peak, marking one of the most significant corrections in the post-halving cycle following the April 2024 event. While technical patterns have contributed to the volatility, the move is fundamentally driven by shifts in institutional demand, macroeconomic pressures, and market dynamics. it is worth noting that the most famous cryptocurrency witnessed a weekly retreat, -9.06%, a monthly retreat of -12.48%, and year-to-date dip of -21.74%.

The Historic Run-Up: Post-Halving Surge to Record Highs

Bitcoin’s climb to $126K was fueled by the classic halving-cycle dynamics amplified by mainstream adoption. The April 2024 halving reduced new supply issuance, historically triggering multi-year bull runs as scarcity intensified. This time, the rally was supercharged by:

Massive inflows into U.S. spot Bitcoin ETFs launched in early 2024, which accumulated hundreds of thousands of BTC throughout 2025.

Institutional and corporate adoption, including potential strategic reserves and broader financial integration.

Macro tailwinds like inflation hedging narratives and a risk-on environment in 2025.

The peak in October 2025 represented the euphoric top of the cycle, with prices reflecting extreme optimism.

Current Snapshot (February 3, 2026)

Live Price: ~$78,392 USD (with 24-hour volume exceeding $80B).

Recent Lows: Dipped below $77,000 over the weekend, hitting fresh 2026 lows.

Market Cap: Still dominant at over $1.5 trillion.

Year-to-Date Performance: Down significantly from January highs around $90K+.

Context: The drop accelerated in late January/early February, coinciding with broader risk-asset weakness.

Source: TradingView

Core Fundamental Drivers Behind the Decline

This correction isn’t random—it’s rooted in several interconnected fundamental shifts that have flipped the momentum from accumulation to distribution.

Massive Outflows from Bitcoin ETFs

U.S. spot Bitcoin ETFs have seen substantial net outflows in early 2026, totaling billions of dollars and thousands of BTC. Examples include ~$6 billion in exits year-to-date, single-day outflows nearing $1 billion, and cumulative 2026 flows turning negative compared to the strong inflows of 2024–2025. This has removed a major source of buy-side pressure that previously supported prices, as institutional conviction cooled amid volatility and losses for late buyers.

Macroeconomic and Risk-Off Pressures

Broader markets have shifted to a “risk-off” mode, with Bitcoin behaving like a high-beta, liquidity-sensitive asset rather than a pure inflation hedge. Key contributors:

Rally in the Japanese yen triggering global portfolio rebalancing and unwinds.

Weaker U.S. dollar failing to lift BTC (unlike gold), as investors rotate out of volatile assets.

Reassessment of risk amid volatility spikes, forced liquidations in leveraged derivatives, and macro uncertainty (e.g., potential Fed policy impacts).

Profit-Taking, Whale Activity, and Cascade Effects

Long-term holders and whales have engaged in significant selling to lock in gains from the 2025 run-up. This has been amplified by:

Liquidation cascades in derivatives markets, exacerbating downward momentum.

Institutional fund flows turning negative, with ETF buyers sitting on losses.

Technical breaches (e.g., below key moving averages) triggering further algorithmic and stop-loss selling.

Other Contributing Factors

Reduced conviction in the “debasement trade” narrative amid shifting macro conditions.

Heightened volatility and options market signals pointing to downside risks.

Post-peak cycle normalization, where corrections are common after halving-driven euphoria.

Long-Term Fundamentals: Still Intact

Despite the pain, Bitcoin’s core strengths remain:

Fixed supply cap of 21 million coins and ongoing halvings reinforcing scarcity.

Growing institutional infrastructure (ETFs, custody solutions).

Historical resilience through cycles—previous post-peak corrections have led to new highs.

Many analysts see this as a healthy reset in a longer bull cycle, with potential for recovery if inflows return and macro stabilizes. However, risks of further downside persist if outflows accelerate or macro conditions worsen.

This 2026 retreat highlights Bitcoin’s maturation: it’s no longer decoupled from traditional markets, but its fundamentals continue to underpin a compelling long-term case.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations