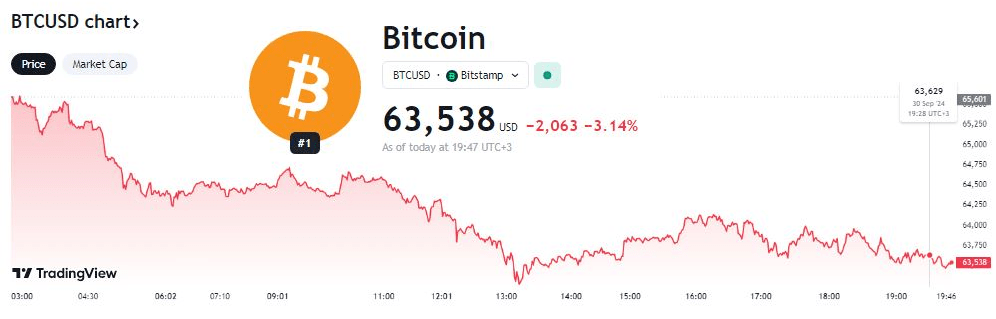

Bitcoin experienced a significant price dip in September, falling to near $63,000. This decline was attributed to technical overbuying conditions and a broader market correction. Despite this temporary setback, the cryptocurrency remains on track for its strongest September in several years, with gains of over 7% for the month. On the daily chart, the most famous cryptocurrency is -3.14% down; trading at $63538.

Impact of Crypto ETFs and Federal Reserve Policies

\The cryptocurrency market saw a surge in inflows to crypto ETFs, totaling $1.2 billion in the previous week. This growth was primarily driven by expectations of interest rate cuts by the Federal Reserve. Bitcoin-focused funds attracted over $1 billion of these inflows, indicating growing investor confidence in the digital asset.

Geopolitical Factors and Bitcoin’s Price Sensitivity

The recent decline in Bitcoin’s price was also influenced by geopolitical events. Following Israeli airstrikes on Beirut, the cryptocurrency experienced a sell-off. This pattern has been observed in the past, as Bitcoin often reacts negatively to regional unrest. Despite its reputation as a hedge against instability, Bitcoin can be susceptible to market volatility during times of geopolitical crisis.

Outlook for Bitcoin

As we enter October, Bitcoin is positioned for potential gains, building on its positive performance in September. The cryptocurrency’s resilience in the face of recent price fluctuations and its ability to attract significant investor interest suggest a promising outlook. However, it’s essential to remain cautious, as the market can be subject to sudden shifts influenced by various factors, including macroeconomic conditions and geopolitical events.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations