The pair moved lower in line with the previous bearish outlook, approaching the first downside target at 1.1665 and recording a low of 1.1683.

Technical Outlook:

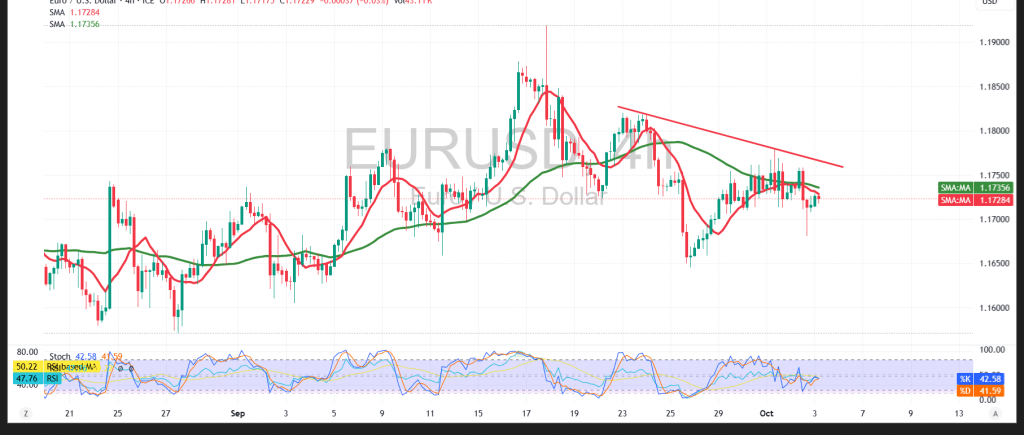

- 50-day SMA: Price action remains capped below the moving average, which acts as dynamic resistance, limiting upside potential.

- RSI: After a brief intraday rise, the indicator entered overbought territory, reflecting weak bullish momentum.

- Trendline: Movement remains aligned with a descending channel, confirming the broader downtrend.

Probable Scenario:

- Bearish Case: Stability below 1.1760 reinforces the downside bias, with a break of 1.1690 paving the way toward 1.1645 and then 1.1605.

- Bullish Case: A confirmed break above 1.1765 could restart recovery attempts, targeting 1.1800 and potentially extending gains to 1.1835.

Risk Warning: Today’s high-impact US data releases (Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings) could trigger strong volatility. Risks remain elevated amid trade tensions and geopolitical uncertainty, keeping all scenarios possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1685 | R1: 1.1760 |

| S2: 1.1645 | R2: 1.1800 |

| S3: 1.1600 | R3: 1.1835 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations