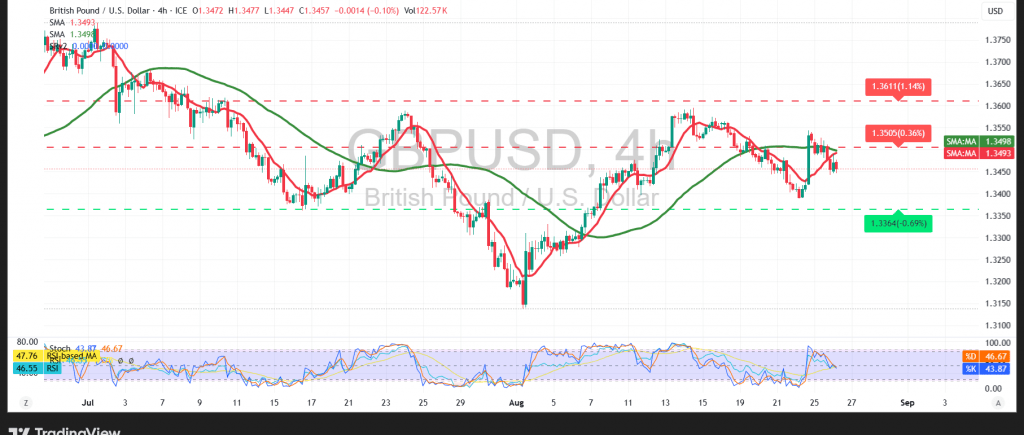

Negative trading dominated the movements of the GBP/USD pair during the morning session, following its failure to achieve a daily close above the psychological resistance at 1.3500.

Technical Outlook – 4-hour timeframe:

The pair’s continued stability below the simple moving average strengthens the likelihood of sustained selling pressure, particularly with the clear negative signals from the Relative Strength Index (RSI). This comes in line with the ongoing dominance of a minor bearish wave, reinforcing expectations for a continuation of the downward trend.

Probable Scenario:

As long as the price remains below 1.3500, the bearish outlook prevails, with downside targets at 1.3420 as the first support, followed by 1.3390. A further extension of the decline could open the way toward 1.3340.

Conversely:

A confirmed breakout above 1.3500 could negate the bearish scenario and shift momentum to the upside, allowing for a recovery attempt toward 1.3560, with 1.3590 as the next resistance.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3425 | R1: 1.3505 |

| S2: 1.3390 | R2: 1.3560 |

| S3: 1.3340 | R3: 1.3590 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations