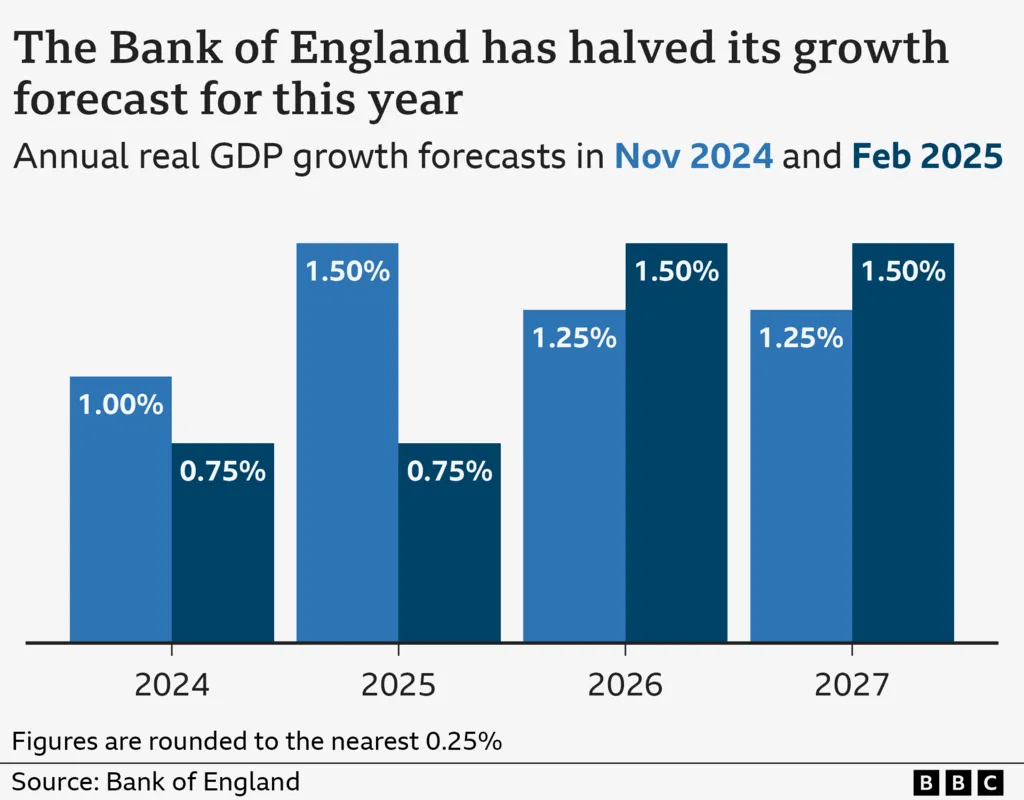

The Bank of England recently cut interest rates to 4.5% from 4.75% and significantly lowered its economic growth forecast for 2025 from 1.5% to 0.75%. While they upgraded growth predictions for 2026 and 2027, they also warned of rising inflation due to increased energy and water bills, potentially reaching 3.7% and not falling back to the 2% target until late 2027.

Here’s a breakdown of the key points:

Rate Cut: The Bank of England lowered interest rates to 4.5%, the lowest in 18 months, signaling a continued downward trend. This cut will likely reduce mortgage payments for some homeowners but also lower returns for savers.

Growth Forecast Downgrade: The bank dramatically cut its growth forecast for 2025, citing factors like the impact of the government’s budget (specifically increased employer National Insurance contributions), higher energy costs, and potential trade wars. This downgrade is a blow to the government’s efforts to boost the economy.

Inflation Concerns: Despite the rate cut, the Bank predicts a sharp rise in inflation due to rising energy and water bills. They also acknowledge uncertainties like potential US trade tariffs that could further impact inflation. They expect inflation to remain above target until late 2027.

Uncertainty and Risks: The Bank of England emphasized the uncertain global economic environment and the need for a “gradual and careful” approach to further rate cuts. They highlighted risks to both inflation accelerating and falling faster than expected.

Impact of Government Policies: The Bank explicitly mentioned the government’s budget, particularly the increase in employer’s National Insurance contributions, as a factor contributing to lower business and consumer confidence. They are closely monitoring how these increased employment costs will affect the economy.

Political Reactions: The Prime Minister acknowledged the growth concerns, while the Shadow Chancellor criticized the government’s budget and its potential impact on future rate cuts. The director of the Institute for Fiscal Studies called the growth downgrade “very worrying” and suggested it could create problems for the Chancellor in meeting debt rules.

Mortgage and Savings Impact: The interest rate cut will likely lead to lower monthly mortgage payments for some homeowners, particularly those on tracker mortgages. However, it will also likely result in lower returns for savers.

In short, the Bank of England’s actions and forecasts paint a picture of a slowing economy facing inflationary pressures and significant uncertainties. The rate cut is an attempt to stimulate growth, but the Bank is proceeding cautiously due to the various risks on the horizon.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations