Today marks the eagerly anticipated release of the most crucial US employment data, the Non-Farm Payrolls (NFP) report, promising insights into the economic landscape of the United States. Anticipation looms large as expectations lean towards a notable deceleration in job growth, counterbalanced by a projected stability in the unemployment rate and a modest dip in wage expansion.

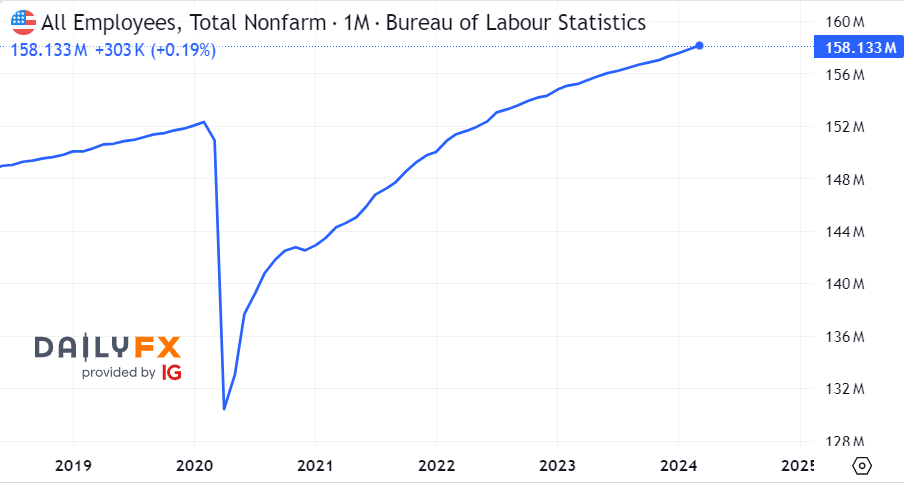

Following a robust reading of 303,000 new jobs added in March, April 2024 is forecasted to witness a more modest increase of 240,000 positions, according to the Dow Jones consensus. Despite earlier forecasts of a slowdown, the US labor market has defied expectations this year, surpassing Wall Street estimates. Friday’s jobs report is poised to affirm this trend, suggesting continued robust hiring in April, while investors keenly scrutinize any hints of weakness that might sway the Federal Reserve’s policy decisions.

The ideal scenario for the Fed would entail a slight miss in wage growth expectations, coupled with a softening of wage pressures as more individuals enter the workforce. Market observers are particularly attentive to wage indicators, with consensus estimates pegging average hourly wage growth at 0.3% month-on-month, hovering around the levels observed in March. This stands against an annual increase of 4%, or just under 4.1% in the previous month. However, these figures could be influenced by immigration trends and the recent uptick in California’s minimum wage to $16 an hour.

The unveiling of employment data on the first Friday of each month, led by the Non-Farm Payrolls report, serves as a pivotal event dictating market sentiment for the ensuing weeks. It casts a revealing light on the state of the US labor market, offering a comprehensive snapshot of the world’s largest economy’s performance.

Beyond merely reflecting economic health, US employment data holds profound significance as it aligns with the Federal Reserve’s dual mandate of fostering price stability and achieving maximum employment. It stands as a testament to the Fed’s ongoing efforts to bolster the nation’s economic vitality.

FED language

May’s employment data are significant because they coincide closely with the Federal Reserve’s recent decisions and statements by Jerome Powell, Chair of the Federal Open Market Committee. This proximity has piqued investors’ interest, as the data serves as a barometer for assessing the central bank’s efficacy in fulfilling its mandates.

Amidst its ongoing battle against escalating inflation, the Federal Reserve opted to maintain the interest rate unchanged during Wednesday’s meeting, refraining from implementing cuts. This decision reflects the central bank’s commitment to addressing inflationary pressures, which have been persistently surging in recent times.

Consequently, the interest rate remains within the range of 5.25% to 5.50%, a level set by the Fed since last July, marking its highest point in approximately 22 years. This steadfast stance signals the Fed’s resolve in managing economic conditions amidst evolving inflationary dynamics.

In its communication, the Fed subtly adjusted its language regarding the progress in fulfilling its dual mandates set by the US administration: price stability and maximum employment. These modifications reflect the central bank’s ongoing assessment and recalibration of its policy framework in response to evolving economic circumstances.

Positive scenario

Anticipating the forthcoming US employment data, we envisage two distinct scenarios, each portraying contrasting possibilities for this pivotal monthly release.

In the optimistic scenario, preliminary employment indicators paint a rosy picture, suggesting favorable outcomes for the most significant economic data point of the month. This scenario heralds potential positive surprises, potentially buoyed by robust job creation, stable unemployment rates, and encouraging wage growth trends.

Conversely, the pessimistic scenario presents a less sanguine outlook, hinting at negative prospects for the forthcoming data. Here, preliminary indicators point towards potential setbacks, such as sluggish job growth, stagnant or worsening unemployment rates, and tepid wage growth figures.

These scenarios serve as guiding signposts, offering insights into the potential trajectories of the US labor market and setting the stage for market reactions based on the eventual unveiling of the employment data.

Optimistic scenario

The prospect of improving US employment data is bolstered by several key preliminary indicators, providing insight into a potentially positive trajectory for the labor market. These indicators include:

- The employment component of the US Services Purchasing Managers’ Index (PMI) surged to 48.5 points in April, up from the previous month’s 48 points.

- The employment component of the US Manufacturing Purchasing Managers’ Index (PMI) also saw an uptick, reaching 47.4 points in April compared to 45.9 points previously.

- The Challenger index of job cancellations in the US declined to 64,789 in April, down from 90,309 the previous month.

- Weekly unemployment benefits claims in the US held steady at 208,000 claims for the week ending April 26, below market expectations of 212,000 claims.

- The total number of US unemployment benefit recipients remained unchanged at 1.774 million for the week ending April 19.

- The labor cost index rose to 1.2% in March, with wages and salaries increasing by 1.1%, sparking concerns about inflationary pressures.

Collectively, these indicators suggest a narrative of resilience and potential improvement in the US labor market, setting the stage for cautiously optimistic expectations ahead of the employment data release.

Pessimistic scenario

In the shadow of a negative scenario looming over the horizon, several key indicators point towards potential headwinds for the US labor market. Here’s a breakdown:

- The productivity index in non-agricultural sectors in the US saw a significant drop to 0.3% in April, contrasting sharply with the previous month’s robust 3.5% increase. Despite this decline, the current reading defied expectations, which had anticipated an even more pessimistic figure of -1.46%.

- The average number of unemployed people over a four-week period dipped to 210,000 claims for the week ending April 26, down from the previous average of 213,500 claims.

- The Electronic Data Processing Administration’s (APD) index of change in non-farm employment in the US reported an increase of 192,000 jobs in April, a decline from the previous reading of 206,000 jobs. Despite this, the index still indicated ongoing job growth, albeit at levels below market expectations of 175,000 jobs.

- The JOLTS job opportunities index decreased to 8.488 million in April, down from the previous reading of 8.813 million and falling short of market expectations of 8.690 million.

- Furthermore, as reported by the University of Michigan, the consumer confidence index dipped to 77.2 points in April, compared to the previous reading of 77.9 points, falling below market expectations of 77.8 points.

With this sombre narrative dominating the landscape, an anticipated decline in US employment data could potentially signal to the Federal Reserve that progresses in the battle against inflation has been substantial. Such a realization might ignite optimism in the markets, potentially favoring risk assets.

Should job growth surpass expectations, a potential recovery in the US dollar may come at the expense of US stocks and gold, as investors recalibrate their portfolios in response to shifting economic dynamics.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations