As the world watches, all eyes are on the Bank of Japan (BoJ) ahead of its March meeting scheduled for tomorrow, Tuesday. Market sentiment is rife with growing expectations that the BoJ might herald the end of negative interest rates, marking a significant departure from the prolonged era of quantitative easing that has persisted for decades.

A Shift in Policy Paradigm: From Quantitative Easing to Rate Hike

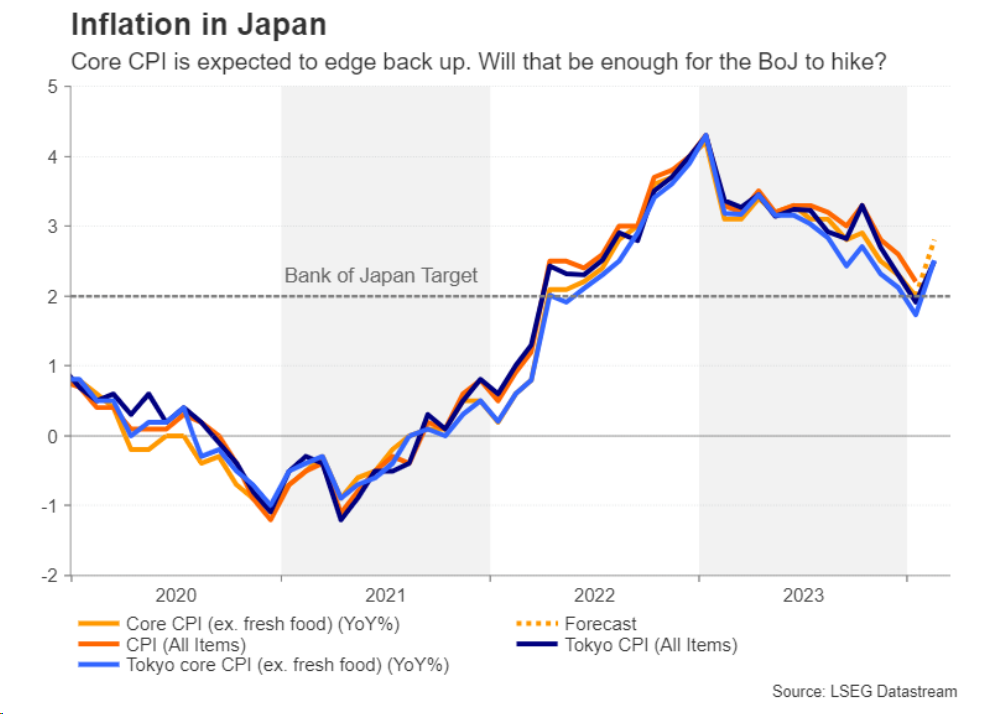

Economists posit that the current juncture presents an opportune moment for the Central Bank of Japan to embark on this trajectory, especially as indicators suggest that inflation rates are stabilizing at or above the coveted 2% threshold—a prerequisite set by the bank for policy reform. Moreover, there’s a consensus that wage hikes, anticipated to materialize throughout the year, further bolster the case for policy recalibration.

The looming anticipation revolves around the prospect of the BoJ raising interest rates, presently pegged at -0.1%, by more than 0.1%, potentially settling within the range of 0%-0.1% in the near term. Additionally, the termination of the yield curve control policy, which caps the 10-year Japanese government bond yield at around 1%, is on the cards.

Yield Curve Control: Key Strategy Under Scrutiny

At the crux of this potential shift lies the yield curve control strategy—a linchpin of the BoJ’s extensive quantitative easing endeavors. This strategy entails augmenting bond purchases to regulate interest rates, signifying a pivotal departure from entrenched monetary policies.

Economic Landscape and Wage Negotiations: Catalysts for Change

The backdrop of the BoJ’s deliberations is punctuated by significant developments, including Japanese companies’ agreement to a 5.28% wage increase during recent spring negotiations—a historic leap not seen since 1991. While these wage hikes signal economic vitality, Bank of Japan Governor Kazuo Oedo maintains a cautious stance, emphasizing the need for sustained evidence of wage growth to underpin the bank’s inflation targets.

Market Speculation and Timing Dilemmas

Market speculations are rife, with a 40% probability attributed to a 10 basis points interest rate hike in March and a 70% likelihood in April. The timing dilemma persists, with divergent opinions on whether the BoJ will act in March or April. While some institutions, such as UBS, favor an April timeline, citing concerns over the economy’s fragility amidst consumption slowdowns, others, like Goldman Sachs, anticipate a March move, fueled by revised economic outlooks.

Economic Resilience and Revised Growth Outlooks

Revised economic data unveiled earlier this month showcased Japan’s resilience, with the economy managing to evade a technical recession during the last quarter of the previous year. Amidst revised GDP indices, indicating a growth of 0.4% instead of the previously recorded contraction, confidence in Japan’s economic trajectory seems to be gaining ground.

Consensus and Expectations: A Landscape of Uncertainty

A Reuters poll revealed a split sentiment among economists, with approximately 35% expecting the end of negative interest rates in March, while 62% anticipate a move in April. Regardless of the timeline, if the BoJ proceeds with an interest rate hike, it would mark a significant departure from decades-long monetary policies, aimed at revitalizing Japan’s economy and steering it away from contractionary trends.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations