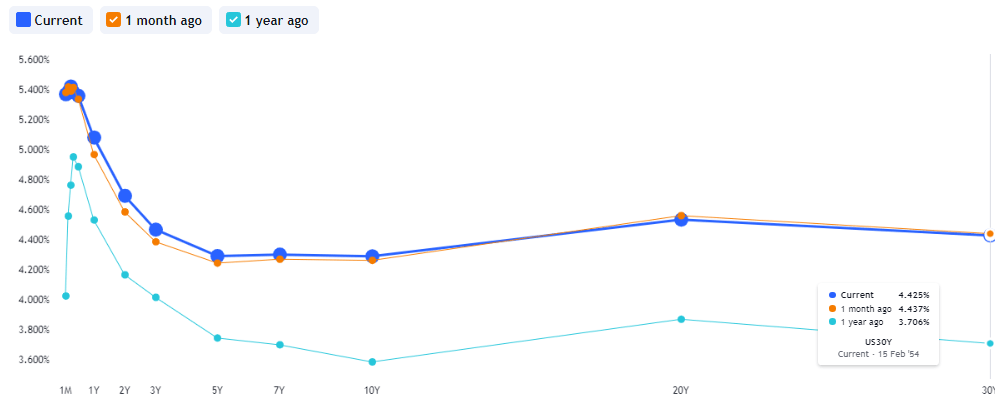

With a shorter-term note (2-year) yielding higher than a longer-term note (10-year), the curve on Friday, March 8, might have been steeper than normal. This could indicate market expectations of Fed to refrain from interest rate cut in March in order to avoid falling in a recession. The Treasury yield curve in 2024 can potentially provide valuable insights into the upcoming FOMC meeting’s decision on interest rates. Here’s how:

Steepening Yield Curve

A steeper curve, where yields for longer maturities rise more than shorter ones, might signal expectations of future rate freeze by the FOMC. This is because investors would lose higher compensation for holding long-term bonds if they anticipate interest rate cut in the near future.

Flattening Yield Curve

Conversely, a flattening curve, where the yield spread between short-term and long-term treasuries narrows, could push market participants to believe that FOMC might keep rates unchanged or even, under certain circumstances, raise them at a slower pace than previously anticipated.

Inverted Yield Curve

An inverted yield curve, where short-term rates are higher than long-term rates, is often seen as a potential recession indicator. It can imply that investors are seeking safety in short-term bonds due to concerns about the future health of the US economy, leading them to accept lower returns.

Therefore, by analyzing the slope of the Treasury yield curve, one can gauge market expectations regarding the FOMC’s stance on interest rates.

Source: Tradingview.com

Looking Beyond the Slope

While the overall slope of the yield curve is important, the finer details matter more. By examining how yields change for different maturity lengths (short-term vs. long-term), investors can gain a richer understanding of market expectations.

The Wider Lens

The yield curve doesn’t exist in a vacuum. Geopolitical events, global economic conditions, and other factors can all play a role in shaping it. Therefore, to fully interpret the curve, we need to consider these influences alongside the Federal Open Market Committee’s (FOMC) policy decisions.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations