In the previous trading session, negative sentiment dominated the price movements of gold following the release of US inflation data, which bolstered the dollar’s performance at the expense of gold’s attractiveness.

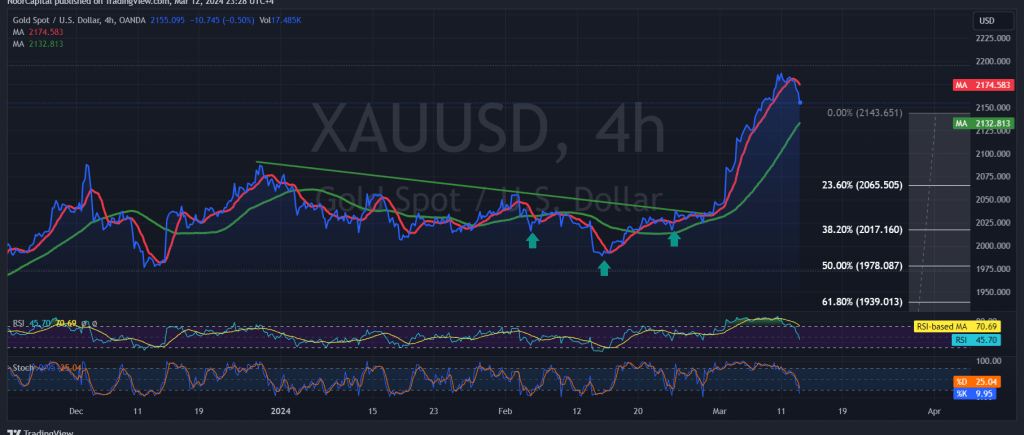

Today’s technical analysis reveals that the 2184 resistance level is exerting downward pressure on the price, while a closer examination of the 4-hour chart indicates a gradual loss of momentum in the Stochastic indicator. This decline is further compounded by negative signals from the 14-day Momentum indicator.

As a result, there is a possibility of a bearish trend emerging in the coming hours, with the potential for a retest of the critical support level at 2143 before a resumption of the established upward trajectory. It’s important to note that this bearish inclination does not negate the overarching upward movement, with official targets situated around 2196 and 2200 as initial objectives.

Conversely, a break below the previously breached resistance level, now turned support at 2143, could delay further upward movement. In such a scenario, gold prices may experience a minor corrective decline, potentially testing support levels at 2128 and 2107.

Investors should exercise caution due to the elevated risk level, with all potential scenarios remaining plausible. Additionally, ongoing geopolitical tensions may contribute to heightened price volatility, warranting vigilance in trading decisions.

By highlighting key technical indicators and potential price movements, this analysis provides valuable insights for investors navigating the gold market amidst evolving market conditions and geopolitical dynamics.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations