Gold prices surged, buoyed by the support level highlighted in the previous technical report at the price of 2016. This support level played a pivotal role in driving prices upward, aligning with our positive outlook. The market witnessed the attainment of initial official targets, reaching as high as 2042.00.

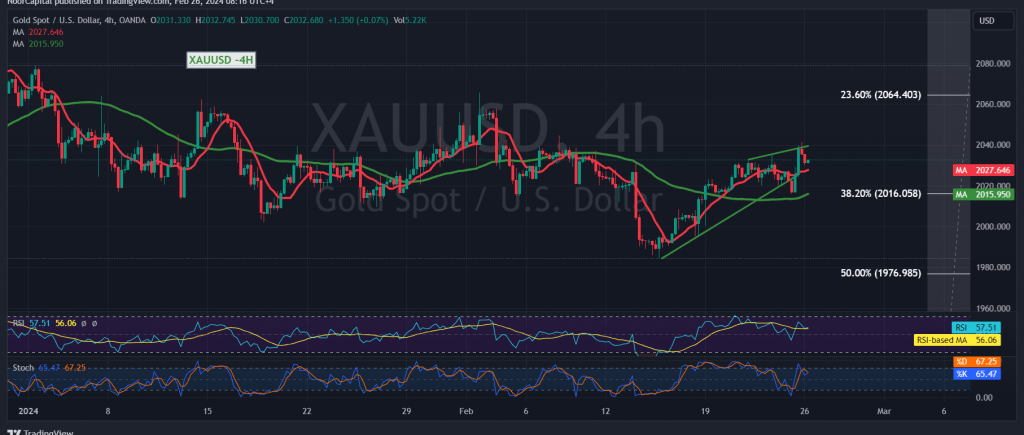

Analyzing the charts today, specifically on the 4-hour timeframe, gold prices demonstrate stability above the crucial support level at 2016, marked by the 38.20% Fibonacci retracement. Furthermore, the presence of the simple moving averages reinforces the ongoing upward trajectory of prices.

With continued positive stability above the key support level at 2016, the bullish trend remains intact and robust. Notably, a consolidation above 2035 serves as a catalyst, propelling prices towards subsequent targets at 2042 and 2055, with potential extensions towards the 2065 levels, marking official stations for the current bullish momentum.

However, it’s essential to be mindful of the consequences of failing to sustain positive stability above 2016. Such a scenario may exert initial downward pressure, targeting levels around 2004 and 1993, with the official target set at 1977 should a corrective decline ensue.

Warning: The Stochastic indicator shows attempts to alleviate current negativity, potentially leading to price fluctuations until a definitive trend is established.

Warning: Given ongoing geopolitical tensions, there remains a high level of risk, which could result in significant price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations