Gold’s efforts to secure gains persist, albeit within constrained limits. The precious metal finds itself grappling with stabilization above the pivotal 2016 level, a critical determinant of medium-term trends, with prices reaching as high as $2023 per ounce.

Technical Analysis Highlights Consolidation Efforts

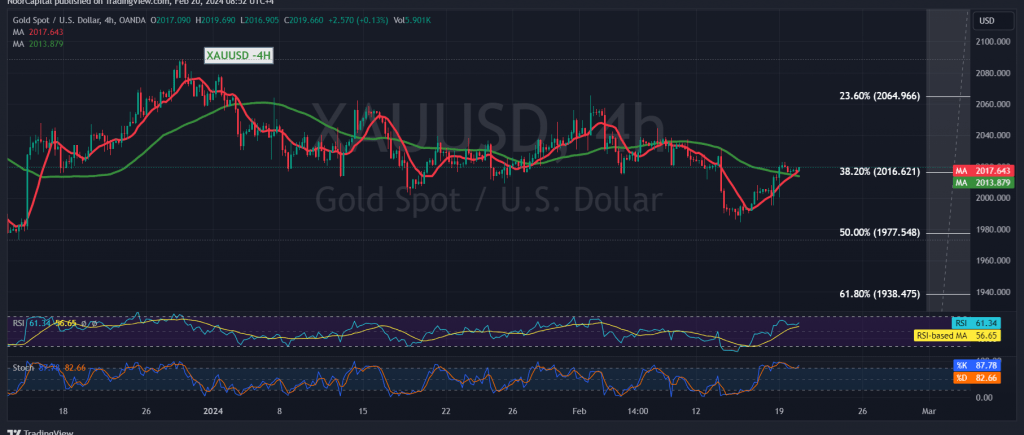

Today’s technical analysis, focusing on the 240-minute time frame chart, reveals gold’s struggle to consolidate above the previously breached support level, now acting as a resistance according to the concept of role reversal at the 2016 Fibonacci retracement price of 38.20%. Additionally, the presence of the 50-day simple moving average provides further encouragement for potential gains.

Upward Trend Most Probable with Upside Targets

Given the technical outlook, the most likely scenario for the day is an upward trend, targeting $2027 and $2036, respectively. Confirmation of breaching the $2036 level would pave the way for further gains, directing prices towards $2050.

Risk Warning Amidst Geopolitical Tensions

It’s important to note the high-risk nature of current market conditions. Geopolitical tensions persist, contributing to heightened volatility in prices. Failure to maintain positive stability above the 2016 level may exert initial downward pressure, with initial targets at $2004 and $2000.

Caution Advised Amid High Risk

Traders are cautioned about the elevated risk levels associated with trading in such an environment. The ongoing geopolitical uncertainties underscore the need for vigilance and prudent risk management strategies to navigate potential market fluctuations effectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations