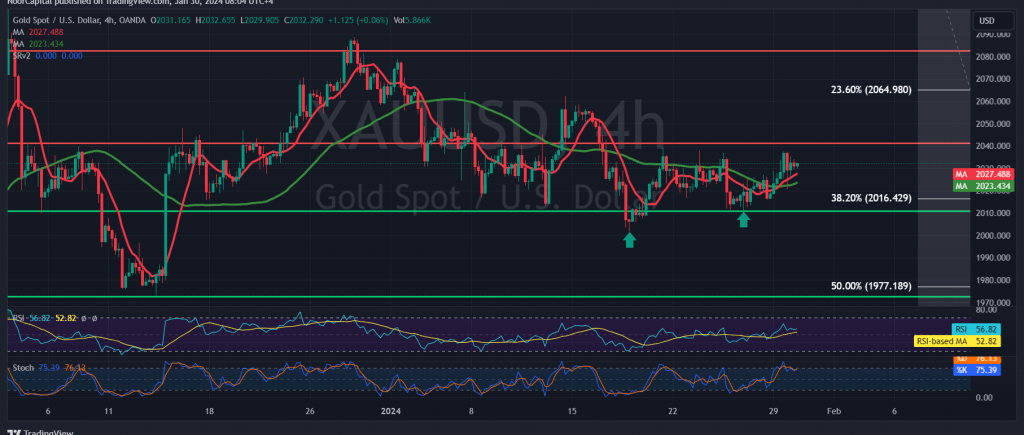

Gold experienced positive trading during the initial sessions of the week, breaking free from a recent period of sideways movement. The precious metal established a robust support level around the 2016 mark.

From a technical perspective today, the outlook tends towards optimism, relying on the stability of trading above the key 2016 support zone, positioned at the 38.20% Fibonacci retracement. Additionally, the ongoing support from simple moving averages provides a positive momentum for daily price trends.

Consequently, the prevailing inclination is towards an upward trajectory throughout the day, targeting $2040 as the initial objective, followed by $2048. It’s worth noting that consolidating prices above $2048 serves as a catalyst, increasing the likelihood of reaching the official target at $2065.

It is important to emphasize that the realization of the proposed bullish scenario hinges on maintaining stability in trading above the 2016 level. A breach of this level could thwart upward movements, subjecting the price to substantial downward pressure, with a corrective target set at $1977.

Caution is advised as we await the release of high-impact economic data related to the US economy—the Consumer Confidence Index today. The time of the news release may witness heightened price volatility.

Warning: The risk level is elevated, particularly in the context of ongoing geopolitical tensions, and potential high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations