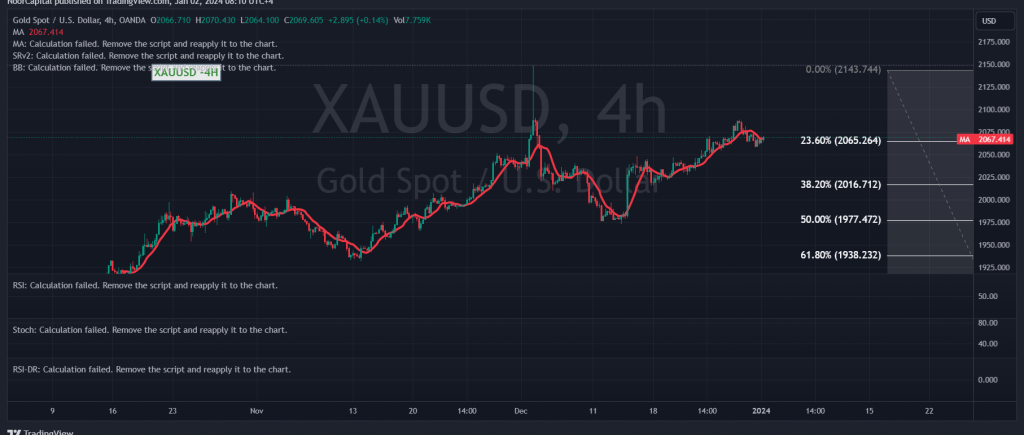

Gold prices are striving to maintain a positive stance as the first trading sessions of the week commence, successfully re-establishing stability above the crucial support level of 2065.

From a technical analysis standpoint, a closer examination of the 4-hour chart reveals that the simple moving averages are reinforcing the upward trajectory of daily prices. This is further supported by clear positive signals on the Relative Strength Index (RSI) on short time frames.

In light of the current scenario, where intraday trading remains above 2065, representing the Fibonacci retracement level of 23.60%, and more broadly 2060, the bullish scenario maintains its validity and effectiveness. The initial target in this context is set at 2076, and surpassing this level not only reinforces but also accelerates the strength of the upward trend, paving the way directly towards 2083.

It is crucial to be mindful that a close of at least a one-hour candle below 2060 places the price under negative pressure. Such a development may provide an opportunity for a retest of support levels at 2051 and 2045 before any potential resurgence.

Risk levels should be approached with caution. The ongoing geopolitical tensions contribute to a high-risk environment, potentially resulting in elevated price volatility. Traders are advised to exercise caution and stay vigilant in light of these factors.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations