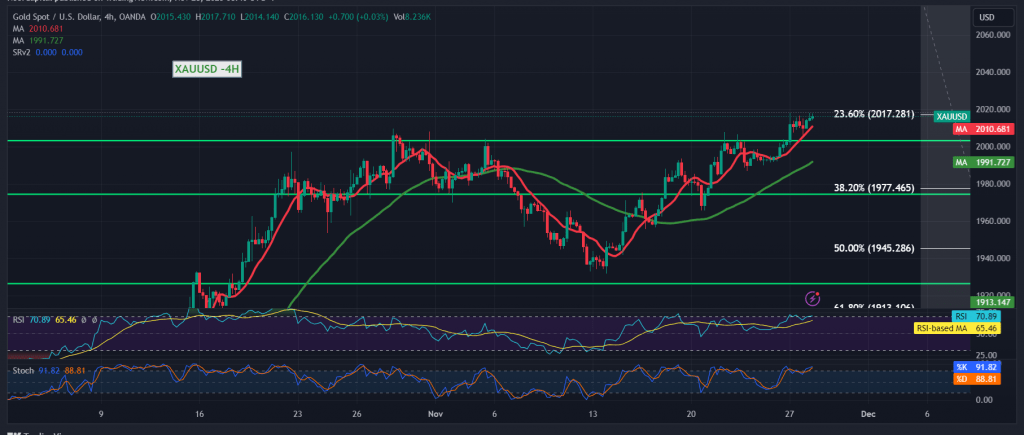

Gold prices surged to achieve significant gains yesterday, meeting the expectations outlined in the previous technical report. The precious metal touched the second official target set in the report, reaching a peak of $2018 per ounce, which corresponds to the 2017 price level.

Today’s technical analysis suggests the potential for a continuation of the upward trend. This outlook is based on the stability of trading above the psychological barrier of 2000, which has now transformed into a support level following the concept of role reversal. Additionally, the simple moving averages continue to provide positive support for potential upward movement.

Intraday trading is considered favorable as long as the price remains above the support levels at 2004, with particular attention to the critical level of 2000. In such a scenario, the most likely outcome is an upward trajectory during the day, targeting 2022 as the initial objective. Breaching this level further strengthens the case for an extended rise, with the next official target at 2029.

It’s important to note that a breach below 2004, especially 2000, would invalidate the proposed bullish scenario. In such a case, the market could witness a downward trend aimed at retesting support levels at 1993 and 1986 before potential renewed attempts to rise.

Caution is advised as the Stochastic indicator is currently around overbought areas, and some price fluctuations may occur until a clear directional signal is established. Moreover, the level of risk is considered high due to ongoing geopolitical tensions, potentially leading to increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations