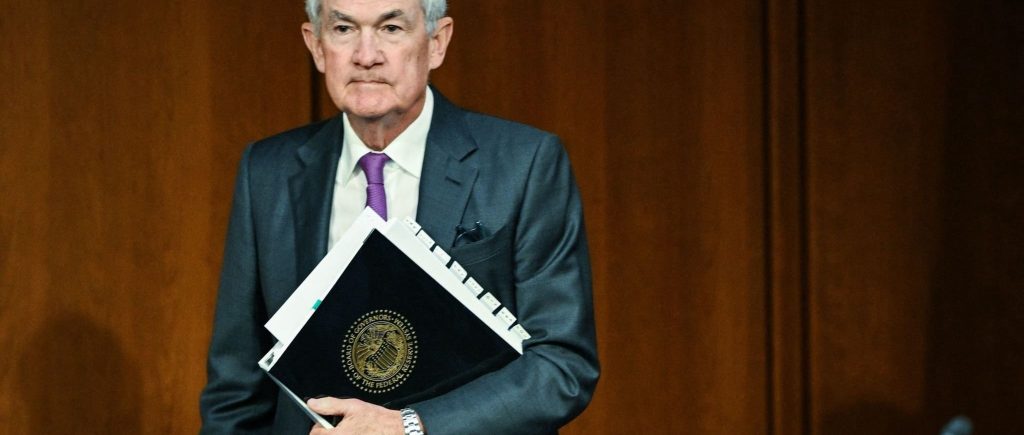

The benchmark funds rate was held unchanged in September by the Fed in a range of 5.25% to 5.5%. Jerome Powell, the chair of the Fed, has provided his forecast on rates, the economy, and the possibility of a gentle landing. The central bank has increased its benchmark borrowing rate 11 times since March 2022, which has an effect on consumers as returns on savings and loans rise.

According to Powell, the Fed might not have access to the inflation data it usually uses to inform its rate decision in November if there is a government shutdown. Powell clarified that, if that scenario materialises, the central bank will simply have to deal with it. If it did, a variety of variables would be involved.

Powell stated that the central bank’s first aim is to restore price stability, and that doing so will have substantial negative effects on the economy. He claimed that failing to restore price stability is the worst thing the Fed can do, as doing so might trigger a return of inflation and have an adverse effect on economy.

A soft landing is conceivable but not the norm, according to Powell. When questioned if a gentle landing was a “baseline expectation,” he said no and clarified that such a situation was in fact feasible. Powell added that the Fed officials’ optimism in the economy has more to do with the adjustment to fewer forecast rate cuts in 2024 than their growing anxiety over stubborn inflation.

Stronger economic activity drove projections for fewer rate cuts in 2024, Powell said. He said that broadly, stronger activity means we have to do more with rates, and that’s what the meeting is telling you.

According to Chair Jerome Powell, the Fed is not yet totally confident that inflation is moving in the correct direction. While there are some promising indicators that price pressures are moderating, according to Powell, the work of bringing inflation back down to the target level of 2% is far from done. Even if inflation has slightly slowed down since the middle of last year, he claimed that longer-term inflation expectations continue to be firmly rooted, according to surveys of consumers, businesses, forecasters, and financial markets. However, there is still a long way to go before inflation can be kept below 2%.

The Fed said it might increase rates once more this year before ending its drive to tighten monetary policy, but investors need to be mindful of a significant flaw in the Fed’s dot-plot forecast. Dot plot medians frequently overestimate policy rates, sometimes by a significant margin. The most egregious instance was in 2015, when the Committee predicted that interest rates would exceed 3.50% in 2017, but in reality, they were closer to 0.50%.

According to key investors suggest that the US economy is growing stronger than the Fed thought and no one, not even Powell, knows what the central bank will decide at its November meeting. The Fed is back to a neutral stance on balancing inflation versus employment levels, and the economy is far from the recession many have predicted.

Only small revisions were made from the July statement by the Fed, which renamed economic growth from “moderate” to “solid” and softened language regarding job growth. The S&P 500 and Nasdaq Composite fell 0.1% and 0.4%, respectively, after the Fed decided against raising interest rates in September but said they would stay higher for longer.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations