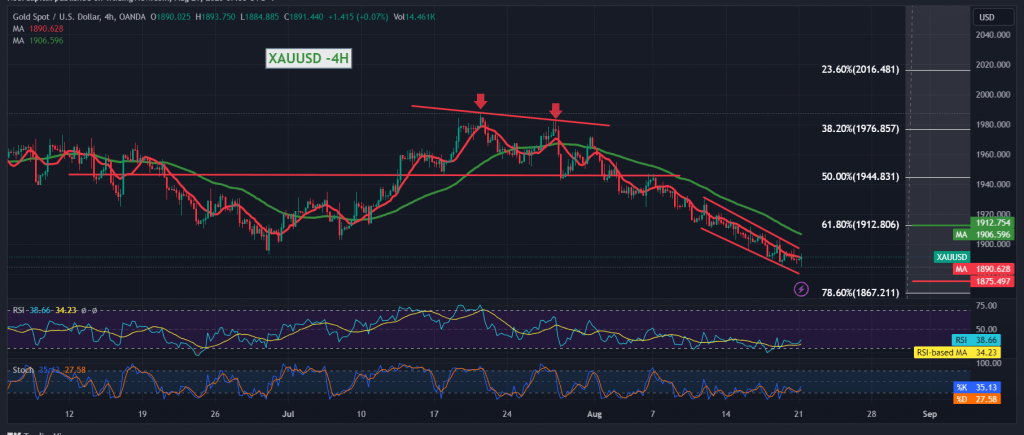

Gold prices continued the expected downward path, reaching the first main station of the current downward wave, at the expected target of 1885, recording its lowest level during the early trading of today’s session, $1885 per ounce.

Today’s technical vision indicates the possibility of witnessing an attempt to establish support around 1885 that might lead gold prices to achieve some temporary rise, and that does not contradict the general bearish trend; with careful consideration, the simple moving averages continue to exert negative pressure on the price from above, accompanied by a decline in momentum.

With the stability of intraday trading below 1913, the previously broken support is now transformed into the Fibonacci correction resistance level of 61.80%. The bearish scenario remains the most preferred, provided that we witness a clear and strong break of the support level of 1885, targeting 1875 and 1873, as next official stations that may determine the next directional movement.

The upside move and the price’s consolidation with a 4-hour candle closing above 1913 postpone the chances of a decline, and gold prices may witness a temporary recovery with the aim of re-testing 1922 and 1929 before the start of the decline again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations