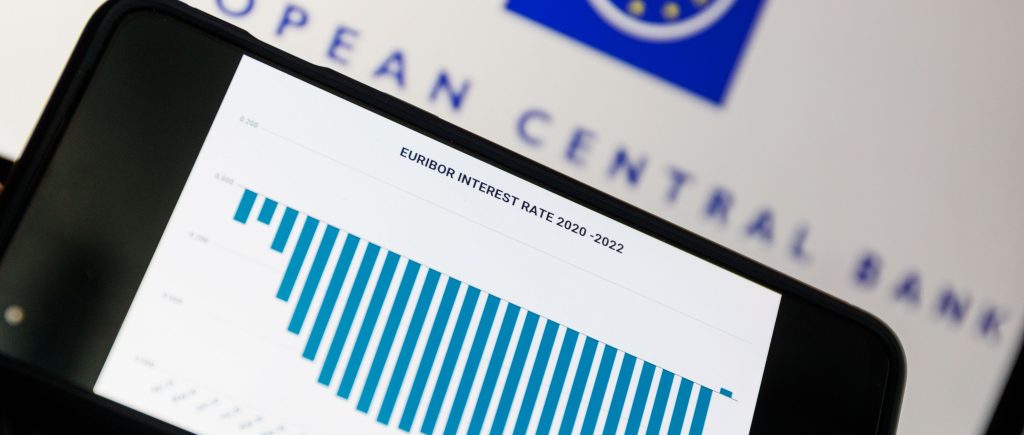

The European Central Bank has completed most of its historic monetary-tightening campaign but there remains some ground to cover, according to Vice President Luis de Guindos.

Without revealing where he sees the peak in interest rates, Guindos said Wednesday that future ECB decisions will hinge on data in the coming months. That will include readings of underlying inflation, on which officials have increasingly focused, and which he said was more persistent than expected.

No changes to the initial estimates as headline annual inflation did tick a little higher while core annual inflation was marginally lower in April compared to March. This still just helps to reaffirm the ongoing ECB narrative.

Earlier on Wednesday, ECB’s Pablo Hernandez de Cos said “the persistence of higher inflation would slow the recovery and would very likely lead to further tightening in the euro area.”

At the time of writing, the EUR/USD is trading at 1.0841, up 0.02%. But, earlier on Wednesday, the pair extended losses toward 1.0800, down 0.33% on the day at 1.0826. Broad-based US Dollar strength amid a cautious market mood is weighing on the main currency pair.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations