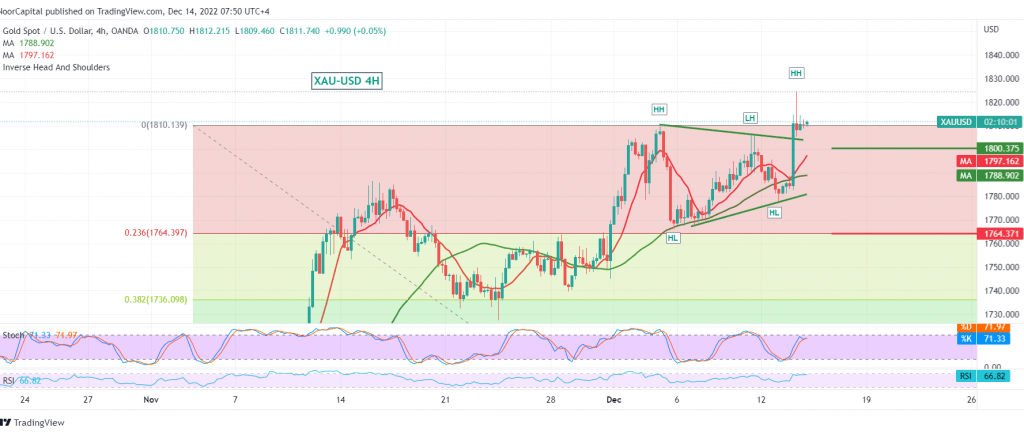

Gold prices jumped during the previous trading session, taking advantage of the pressure on the US dollar index after the US inflation data, and as a reminder, we adhered to intraday neutrality during the previous technical report due to the conflicting technical signals, explaining that the activation of buying positions depends on cohesion above 1800 targeting 1820 so that gold can touch the target The asking price, reaching its highest level at $1824 per ounce.

The technical side today indicates the possibility of continuing the rise, relying on the continuation of the simple moving averages providing a positive impulse, accompanied by the clear positive signs on the RSI.

From here, with steadfast trading above the resistance that was previously breached and now turned into a support level 1786, the bullish scenario remains the most likely, targeting 1829 first, knowing that the official target for the rise that started yesterday at 1848/1850.

The decline below 1786 puts the price under negative pressure, and we await a retest of 1764 bottom, 23.60% Fibonacci correction.

Note: Today we are awaiting high-impact economic data from the United States of America, and we may witness high volatility:

Fed interest rates

Fed statement

Fed press conference

Economic forecasts

Note: Trading on CFDs involves risks and therefore scenarios may be possible. What was explained above is not a recommendation to buy or sell, but rather an illustrative reading of the price movement on the chart.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations