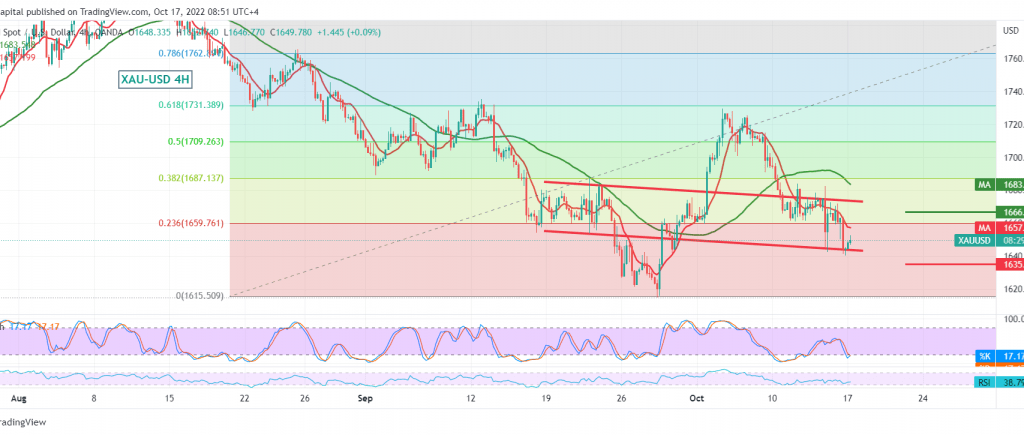

The yellow metal prices achieved the negative outlook as we expected during the previous analysis, explaining that confirming the break of the 1660 support floor facilitated the task required to visit our first target 1646, recording its lowest level at the end of last week’s trading at 1640.

Today’s technicals indicate the possibility of resuming the decline based on the continuation of the negative pressure from the simple moving averages and the resumption of movement within the descending price channel shown on the 4-hour time frame.

Therefore, the bearish tendency is most likely during the day, targeting 1630/1635 first target; considering that the decline below 1630 may extend gold losses, we are waiting for 1622 and 1616 next stations.

Activating the suggested bearish scenario requires daily trading to remain below 1660, and, most importantly 1666, and a breach of the latter may lead to a temporary recovery that aims to retest 1684.

Note: It is important to monitor the price behavior well if 1630 is touched due to its importance to the general trend on an intraday basis.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations