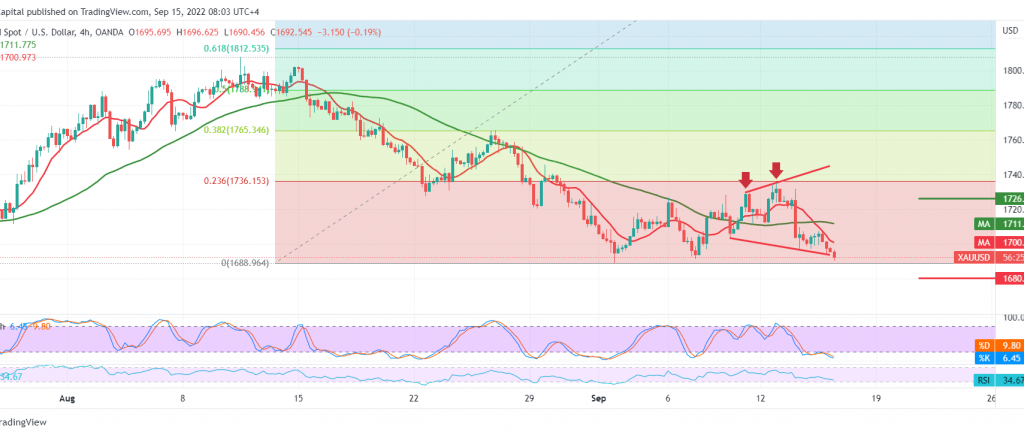

The technical outlook is unchanged, and there was no change in gold’s movements, maintaining the negative stability below the $1700 level per ounce, to start today’s session with a stable bearish tendency around its lowest level during the early trading of the current session at 1690.

Technically, the simple moving averages continue to support the daily bearish curve in prices, accompanied by the stability of the RSI below the 50 mid-line on the short time frames.

Therefore, we maintain our negative outlook towards the rest of the targets of the previous report, the 1685 first target. Then 1680 official stations, and we must pay close attention to this level due to its importance for the general trend in the short term, and breaking it may extend the current downside wave towards $1650 later.

Activating the proposed scenario depends on the stability of the intraday trading below 1702 and below 1713, knowing that the attempt to consolidate above 1713 postpones the bearish scenario but does not cancel it, and we may witness a temporary recovery that aims to retest 1726 initially.

Note: “US Retail Sales” data is due to be released and has a meaningful impact, and we may see high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations