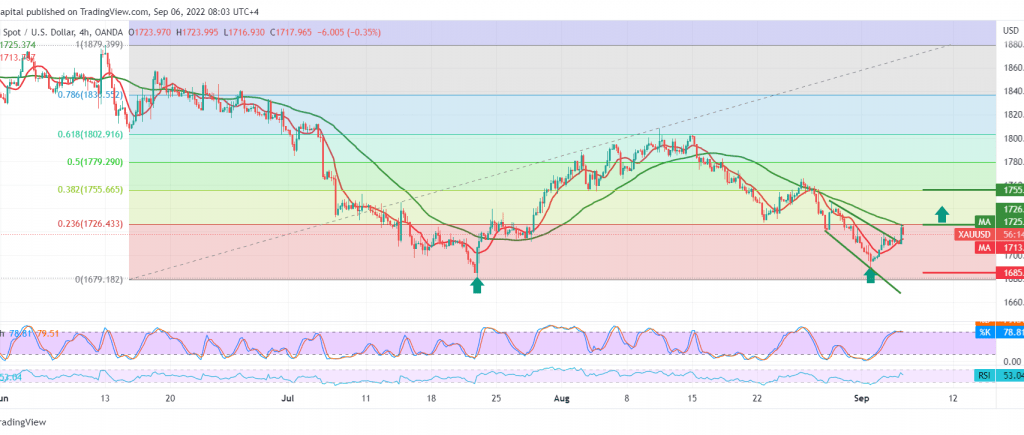

Gold started the first trading sessions this week on a bullish slope, benefiting from the strong demand point located at 1690 price, to retest the 1726 point during the early trading of the current session.

On the technical side today, we find that the 14-day momentum indicator is getting positive momentum signals, in addition to the intraday stability above the 1710 level and, most notably, 1707. Although we tend to be positive, we prefer to confirm the breach of 1726 located at the 23.60% Fibonacci correction as shown on the chart. Able to enhance the chances of rising towards 1735, a first target, and the gains may extend later to visit 1745.

Trading stability below 1707 will immediately stop the proposed scenario and start negative pressure on gold prices, waiting to touch 1697/1700, knowing that breaking 1697 increases the strength of the bearish bias, opening the door to visit 1680 official stations.

Note: Stochastic is about overbought areas in intraday basis.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations