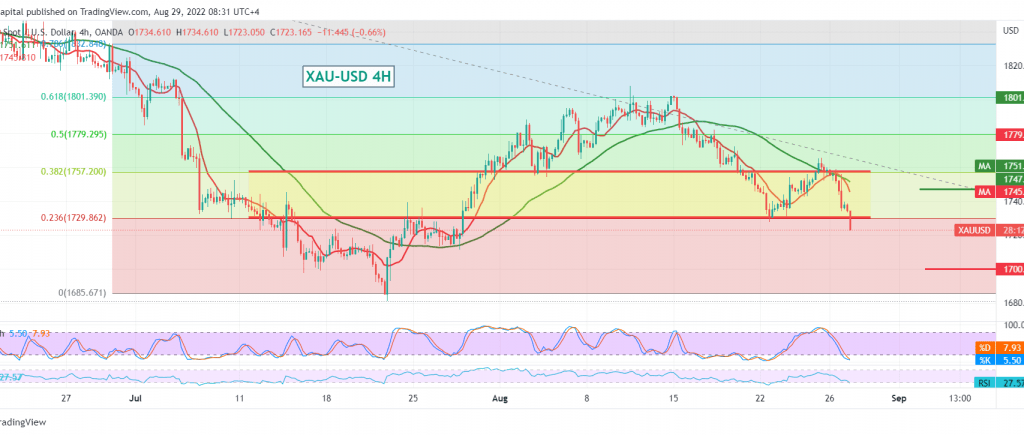

We adhered to intraday neutrality during the last report due to the conflicting technical signals, clarifying and warning that gold prices would break $1747 support level, targeting $1732, so that gold began the first trading sessions of this week to incur significant losses, recording the lowest $1723 during the morning trading of the current session.

Technically, we find gold stable around 1723 after it confirmed the breach of the pivotal support floor, which represents one of the essential directional keys at 1729, 23.60% Fibonacci correction, accompanied by the negative crossover of the simple moving averages.

Therefore, prices may continue to work within the downtrend to visit 1710 first target and then 1700 next waiting stations. However, it should be noted that breaking 1699 increases and accelerates the current descending wave’s strength, waiting for 1676.

Remember that activating the suggested scenario depends on the price stability below 1745.

Note: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations