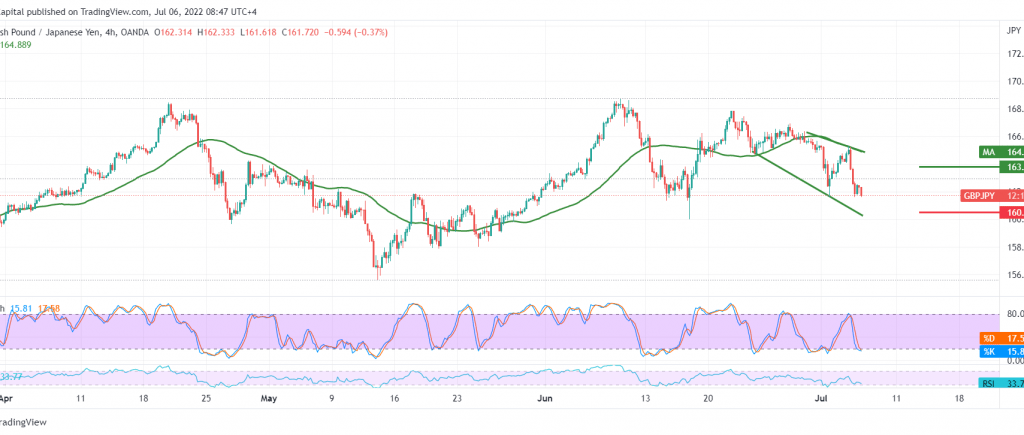

A bearish trend dominated the movements of gbp/jpy during the previous trading session, recording its lowest level around 161.60.

Technically, we tend to the negative, relying on the pair’s pivot below the 162.80 level, with the pair continuing to get negative pressure from the 50-day simple moving average.

Therefore, the bearish scenario is most likely today, provided that we witness a break of 161.50. That opens the door to visiting 160.50 awaited price stations, next targets may extend towards 160.00.

Note: the signs of temporary positivity have begun to appear on the stochastic indicator. We may witness a limited bullish bias before retracing, knowing that the bullish bias does not contradict the bearish trend.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

Note: The Fed’s statement is due today and could lead to some volatility

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations