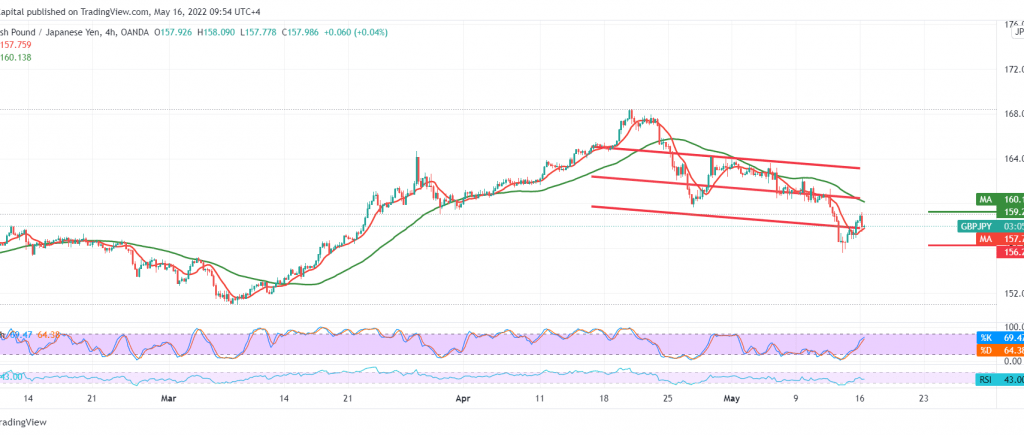

The British pound activated the temporary bullish scenario during the analysis issued last Friday, touching the required target at 159.10, and recording the highest level at 159.24.

On the technical side, the overbought started appearing on the stochastic 4-hour time frame. The intraday stability was below 158.80 and in general, below 159.30.

Therefore, we expect negative movements in the coming hours, knowing that trading below 156.60 facilitates the task required to visit 156.20. The price behavior of the pair must be monitored well around 156.20 because breaking it increases and accelerates the strength of the bearish trend, opening the way to visit 155.20, awaiting station, as long as the price is stable below 159.30.

Rising above 159.30 can thwart the suggested bullish scenario, and the pair may witness a recovery under 160.00 and 160.60.

Note: The risk is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations