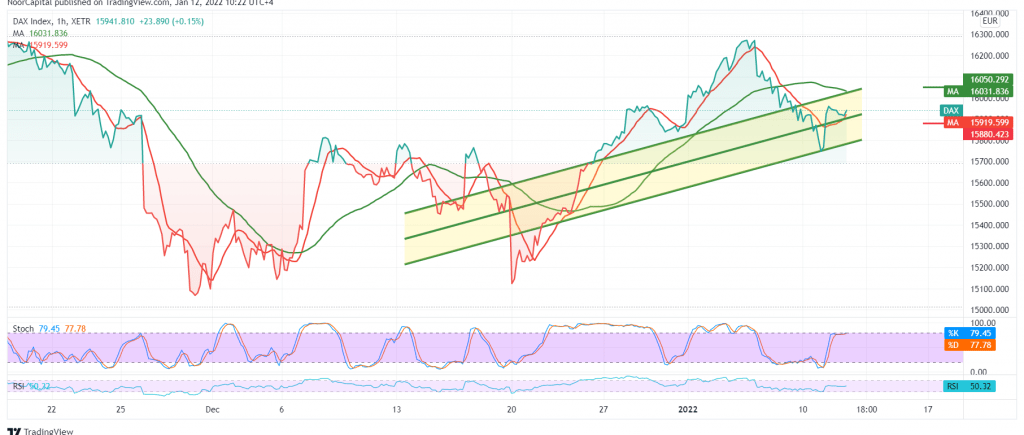

The German DAX index achieved noticeable gains within the bullish path published in the last report, recording its highest level at 15,995.

Technically, we tend to be positive, but cautiously, relying on the stability of the 14-day momentum indicator above the 50 mid-line, in addition to the index’s success in maintaining trading above 15,900.

We may witness a positive trading session, whose first target 16,050. Knowing that the breach of the mentioned level is a motivating factor contributing to strengthening the index’s gains to visit 16,100 and 16,140 initially.

Achieving the suggested bullish scenario depends on the stability of daily trading above 15,900, and most importantly 15,890, and breaking the latter puts the price under negative pressure targeting 15,780.

Note: the level of risk is high and is not commensurate with the return.

Note: CFD trading involves risks; all scenarios are open.

| S1: 15890 | R1: 16050 |

| S2: 15780 | R2: 16100 |

| S3: 15730 | R3: 16200 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations