Positive trading dominated the prices of the yellow metal during yesterday’s session within the expected positive outlook, touching the second official target station at 1827, recording the highest of 1829.

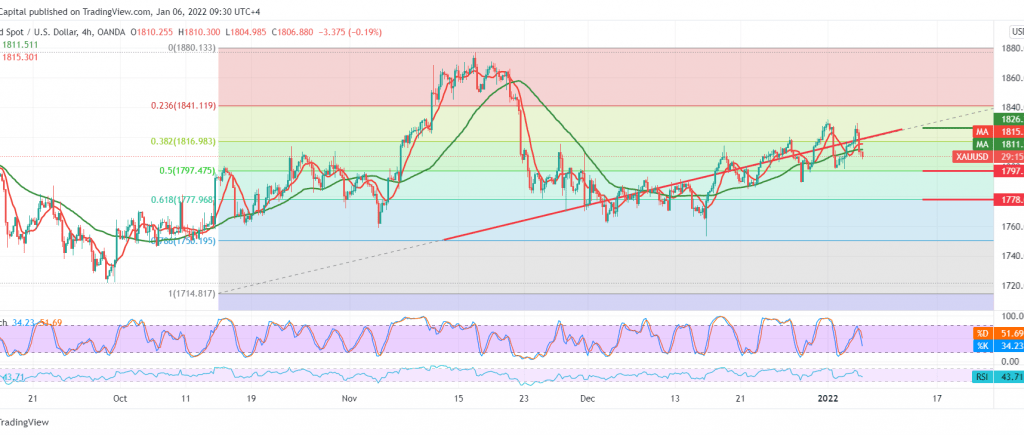

On the technical side, gold prices hit a strong resistance area, which forced the price to move negatively again. With careful consideration of the chart, we notice the 14-day momentum indicator providing negative signals, which comes in conjunction with the stochastic losing the bullish momentum.

From here, we tend to be negative in the coming hours. Still, we prefer to wait for the breach of the pivotal support level 1797 represented by the 50.0% Fibonacci correction. That may extend the losses, and there may be a possibility to visit 1777.00 and 1768, respectively.

Activating the proposed scenario requires the stability of daily trading below 1825, and its breach may stop attempts to retreat and lead gold prices to achieve gains that may be its targets 1835 and 1841.

| S1: 1797.00 | R1: 1820.00 |

| S2: 1777.00 | R2: 1835.00 |

| S3: 1768.00 | R3: 1843.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations