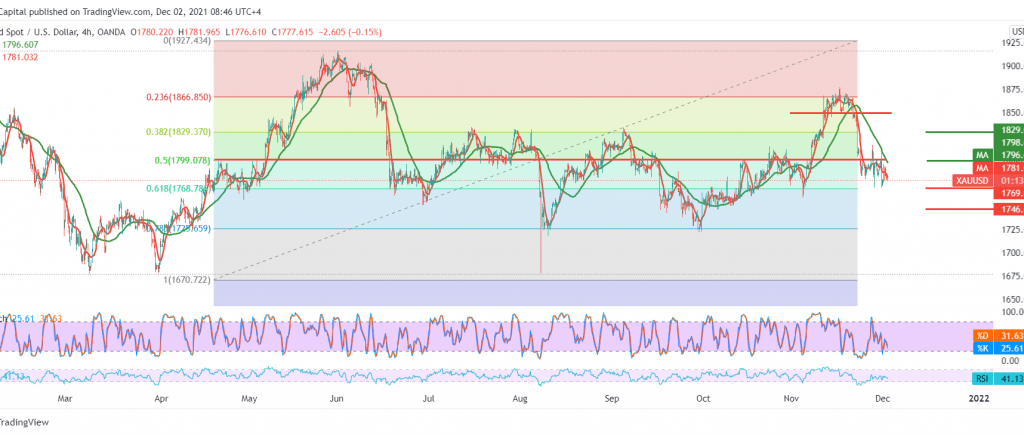

The technical outlook is unchanged, and the yellow metal did not witness a significant change within a short-term bearish trend, tilting to the downside, stable below the main resistance 1799, to start today’s session by pressing on the support level 1768.00.

The technical aspect today needs careful consideration and trading with caution, with the continuation of the clear negative pressure on the simple moving averages that pressure the price from above and the stochastic losing the bullish momentum gradually.

Therefore, with the price remaining below the 1799 pivotal supply area level represented by the 50.0% correction, the proactive path for gold today is a bearish path, targeting 1768, 61.80% correction. 1735.

The breach of 1800 and then 1808 can thwart the expected bearish scenario, and gold recovers to retest 1823 and 1829, Fibonacci correction of 38.20% initially.

Note: The risk level is still high.

| S1: 1768.00 | R1: 1790.00 |

| S2: 1759.00 | R2: 1803.00 |

| S3: 1746.00 | R3: 1812.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations