Positive trading dominated the prices of the yellow metal yesterday, nullifying the negative outlook as we expected and touching the stop losses order published during the previous analysis at 1771; we indicated yesterday that any attempts to breach the 1771 resistance level could postpone the bearish bias and we witness a retest of 1781.

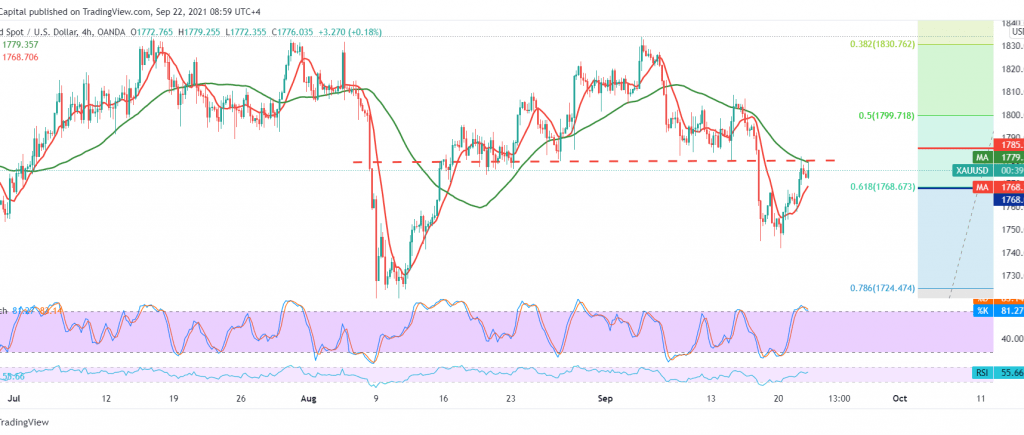

Technically and carefully looking at the 4-hour chart, we notice a conflict between the positive signals coming from the RSI and the clear negativity on Stochastic as a result of entering the overbought areas.

We will remain on the fence for the moment until the daily trend becomes clearer, waiting for one of the following scenarios:

The return of trading stability below the support level of 1768, the 61.80% Fibonacci correction, puts the price under negative pressure again, so we are waiting for 1762 and then 1748, respectively.

Confirmation of the breach of 1780 is a catalyst that enhances the chances of rising to visit 1785 and 1794, respectively, and the gains may extend later to visit 1799, 50.0% correction.

Note: The Federal Reserve’s statement and the Fed’s press conference and we may see price volatility.

| S1: 1762.00 | R1: 1785.00 |

| S2: 1748.00 | R2: 1794.00 |

| S3: 1739.00 | R3: 1808.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations