Gold prices managed to stabilize above the support level of 1750, which pushed the price towards a high of 1758.

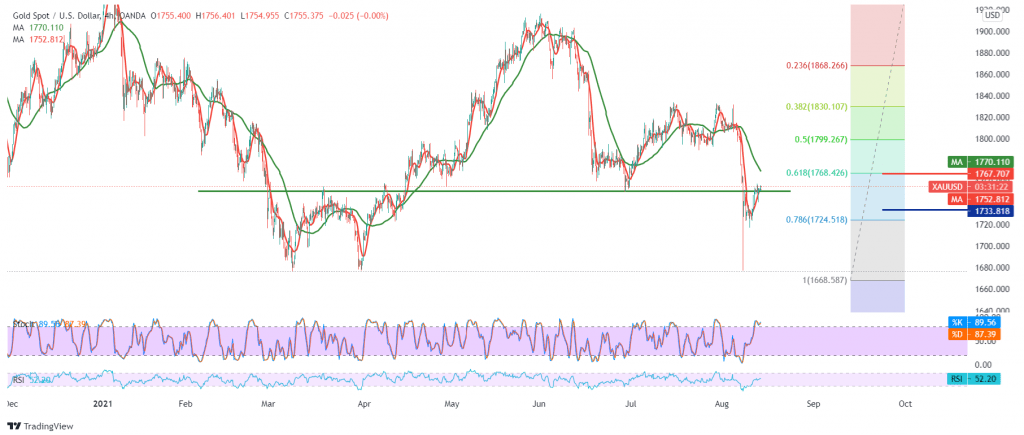

Technically, we tend in our trading to the positive, but cautiously, relying on stability above the mentioned level and the positive motive of the 50-day moving average, which is accompanied by the positive signals coming from the RSI over the short-term.

Therefore, the bullish bias is the most preferred during the day, targeting 1762 first target. Its breach is a catalyst that enhances the chances of rising to visit 1768, Fibonacci retracement of 61.80% initially.

Trading below 1750, and most importantly 1745, will immediately stop the attempts to rise and put the price under negative pressure again, targeting retesting 1734 and 1828, respectively. Note: The level of risk is high.

| S1: 1745.00 | R1: 1762.00 |

| S2: 1734.00 | R2: 1768.00 |

| S3: 1728.00 | R3: 1779.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations